Advanced data analysis in action: Measuring the success of core banking transformation.

After months or even years of intensive efforts modernizing the technology foundations underlying critical banking operations, the cursory post-implementation question often gets posed…

“So, did that whole core systems transformation thing actually achieve what we wanted?”

Fair question. Initiatives involving complex integrations touching vast swaths of infrastructure, data, and personnel don’t come cheap after all.

But accurately evaluating something as sweeping as an enterprise-wide core system overhaul encompasses far more than just tallying project budgets versus cost savings.

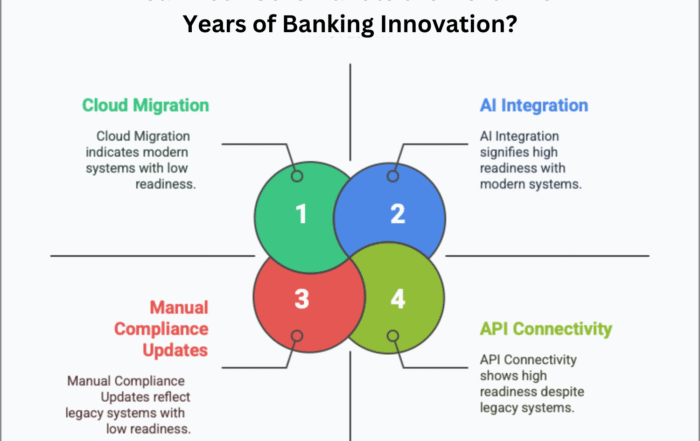

Let’s examine optimal ways to assess success around core banking transformations by evaluating across three key dimensions:

1. Quantitative Business Impact

Cost savings, productivity gains, faster processing, etc.

2. Strategic Enablement

Competitive positioning, accelerated innovation potential, regulatory compliance, etc.

3. Stakeholder Adoption

User sentiment, customer retention, public perception, etc.

Thoroughly analyzing core banking transformation impacts across these areas provides the most complete picture of ROI and overarching value delivered.

#1 Evaluating Quantitative Business Impact

Typical core system initiatives promise hard dollar returns from sunsetting legacy platforms to reduce licensing, maintenance and operational expenses. Those cost savings represent one clear indicator of success.

But limiting evaluations to budgetary line items alone overlooks the holistic impacts on productivity, processing velocity and general performance.

Here’s a checklist of quantitative metrics providing a comprehensive view of your core modernization’s business impacts:

Direct Cost Savings

- Legacy platform licensing/maintenance fees reduced

- Legacy hardware/infrastructure costs reduced

- IT personnel expenses optimized

Productivity Uplift

- Faster new account opening and loan origination

- Higher daily transaction volume per employee

- Fewer manual interventions and workarounds

Enhanced Operations

- Improved straight-through processing rates

- Reduced processing errors and exceptions

- Downtime/outages minimized

Tracking trends across areas like these over regular intervals lets you quantify operational enhancements, efficiency gains, and expense reductions actually realized from core modernization efforts.

#2 Evaluating Strategic Business Enablement

Beyond cost and productivity impacts lies a deeper layer of strategic evaluation around core platform overhauls:

How has this transformation better equipped our institution to achieve critical goals?

Upgraded capabilities can empower banks to deliver new digital offerings, ensure compliance, capture emerging opportunities, and compete long-term.

While less tangibly immediate than cost slashing or processing improvements, elevated strategic enablement is harder to accurately benchmark upfront yet pays exponential dividends over time.

Assess strategic success around core transformations by how well new capabilities facilitate:

Product and Channel Innovation

- Speed launching differentiated mobile/online solutions

- Expanding embedded finance partnerships

- New pricing models and customer tiers

Regulatory Compliance

- Adapting to emerging regulations

- Managing compliance reporting

- Reducing compliance overheads

Data-Driven Decision Making

- Centralizing data across channels

- Enhanced real-time insights into relationships

- Omnichannel analytics

Future-Proofing

- Cloud scalability as needed

- Open architecture for modular innovation

- Vendor flexibility and independence

Factor long-view strategic impacts like these into your value assessments around core modernization efforts.

They can profoundly strengthen competitive positioning over years even if hard to cleanly attribute or project initially.

#3 Evaluating Stakeholder Adoption

Finally, gauge core banking transformation success by adoption levels across critical stakeholder groups:

Employees – Are internal users embracing new solutions?

Is post-implementation sentiment largely positive among frontline staff and IT?

Customers – Has the transition been seamless to end-accountholders?

Are online ratings or retention levels holding steady?

Market – Has public perception or brand reputation been bolstered?

Soliciting candid sentiment across stakeholder groups through surveys, forums and performance patterns reveals actual adoption levels. While qualitative, this feedback offers invaluable real-world validation regarding how transformational efforts are directly serving people.

Smooth adoption and usage across employees and customers ensures invested resources directly translate to better experiences and outcomes vs getting wasted on shelfware.

Key Takeaways: Holistic Evaluation = Clearer Value Picture

Rather than simply asking “did we achieve ROI” on core modernization efforts, frame assessments across interlinked dimensions:

- Quantitative – Direct financials, productivity, performance

- Strategic – Positioning, innovation potential, compliance

- Adoption – User, customer, public adoption levels

This holistic approach clarifies a fuller picture of value realized by tying data points directly back to institutional goals and stakeholder needs.

While core transformations demand substantial initial lifts, take solace that investments made today elevate strategic capabilities over the long haul.

Just be sure to thoroughly monitor outcomes across appropriate success measures to maximize positive impacts.

Found this article interesting? Check out these three related reads for more.

- Assessing core banking transformation success Evaluating the overall impact of the transformation

- Top reasons why transformation efforts fail It’s a people problem

- Navigating change management in core banking Managing the change process and communicating with stakeholders

#TransformationROI #BankingImpact