Delving into the necessity of transforming legacy bank operating models to embrace modern, integrated systems that enhance efficiency and customer satisfaction in the digital age.

Understanding the Operating Model

In today’s fast-paced banking world, the term “operating model” is often mentioned, but what does it really mean? Essentially, an operating model is the blueprint for how a bank functions and delivers value to its customers. It’s the engine that drives the efficiency of people, processes, and technologies working together as an integrated system.

The Legacy Labyrinth

For decades, banks have relied on labor-intensive, siloed operating models with disconnected systems, fragmented processes, and rigid hierarchical structures. Each new product or service added another layer of complexity to this operational web. Picture separate departments for retail banking, commercial lending, and wealth management, each with its own tech stacks and workflows, creating a labyrinth of inefficiency compared to today’s digital-first challengers.

Customer Frustration

Legacy operating models often result in disjointed, high-friction customer experiences. Simple tasks like opening a new account or applying for a loan can turn into endless games of red tape, hand-offs, and repetitive steps, leading to customer dissatisfaction.

Comprehensive Transformation: A Necessity

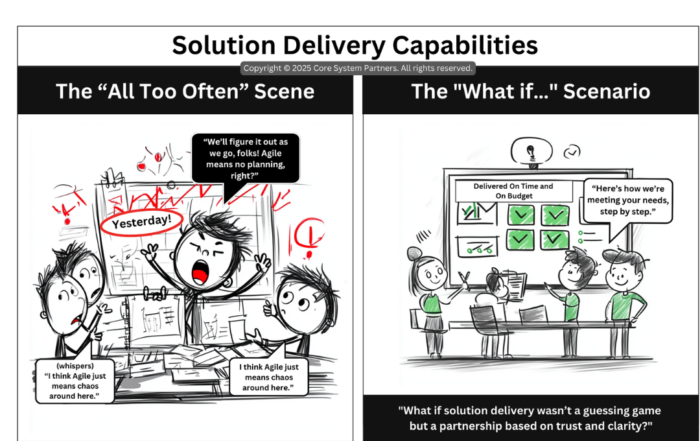

If outdated operating models are the problem, then comprehensive transformation is the solution. However, many banks have attempted transformation by adding new digital channels and front-end experiences without updating the back-end systems and processes. This approach is akin to putting a shiny coat of paint on a car with a crumbling engine.

Beyond Surface Changes

This superficial approach leaves banks with a sleek digital facade that cannot deliver the seamless, personalized experiences promised due to underlying legacy constraints and technical debt. The result is continued disjointed customer journeys, slow time-to-market for new offerings, and rising costs to maintain inefficient operations.

The Path to Modernization

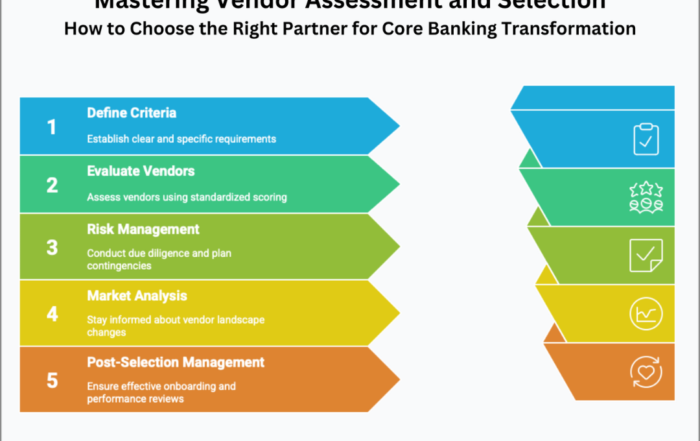

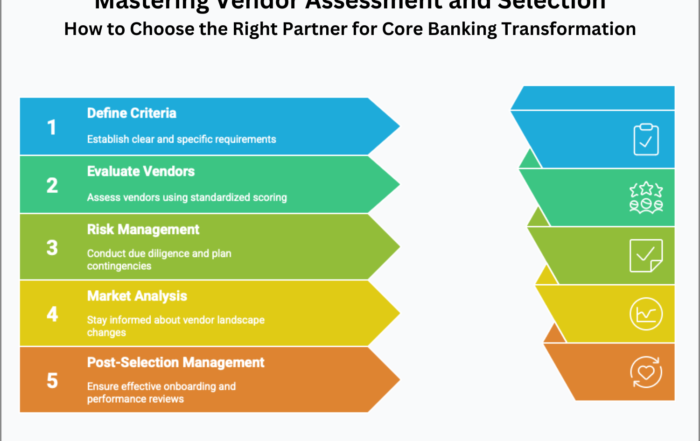

Overhauling a bank’s operating model is essential for achieving sustainable competitive advantage and future-proof operations. This involves not just a simple update but a comprehensive transformation to modernize processes, democratize data, and foster cross-functional collaboration focused on exceptional customer service.

Building the Future Operating Model

In the next steps, we’ll explore the key components of a modernized operating model suited for today’s digital realities. This includes the strategic journey from outdated systems to a future state of seamless processes and collaborative teams.

While the path to modernizing your operating model won’t be easy, the effort is worth it to break free from outdated constraints and achieve efficient, customer-centric operations. So get ready—this transformation journey is just beginning!

Found this article interesting? Check out these three related reads for more.

- Impact of outdated bank technologies and operating models

- Data science for customer-centric banking products

- Core banking system testing Ensuring resilience and compliance

#OperatingModel #CurrentState