Have you ever felt like you’re assembling a 10,000-piece puzzle without the box’s picture?

That’s often what implementing a core banking transformation feels like. The complexity is daunting, and a single misstep can throw everything into disarray. Choosing the proper execution strategy is critical—get it wrong, and you risk spiraling into chaos. Today, we’ll explore the crucial strategy for a successful transformation and how to choose the best approach for your bank.

The Importance of Execution Strategy

Core banking transformations are intricate, involving everything from data migration to overhauling critical processes. The proper execution strategy ensures smooth operation during the transition, minimizing downtime and risks.

Choosing an execution strategy depends on various factors. Here are a few to consider:

- Scale of transformation: Are you updating one aspect or overhauling the entire system?

- Complexity of systems: How do legacy systems integrate with new technologies?

- Risk tolerance: What level of operational disruption can you manage?

- Resources: What are your available time, budget, and workforce resources?

The wrong strategy can extend timelines and amplify challenges, but the right one can streamline the process, reduce risks, and foster success.

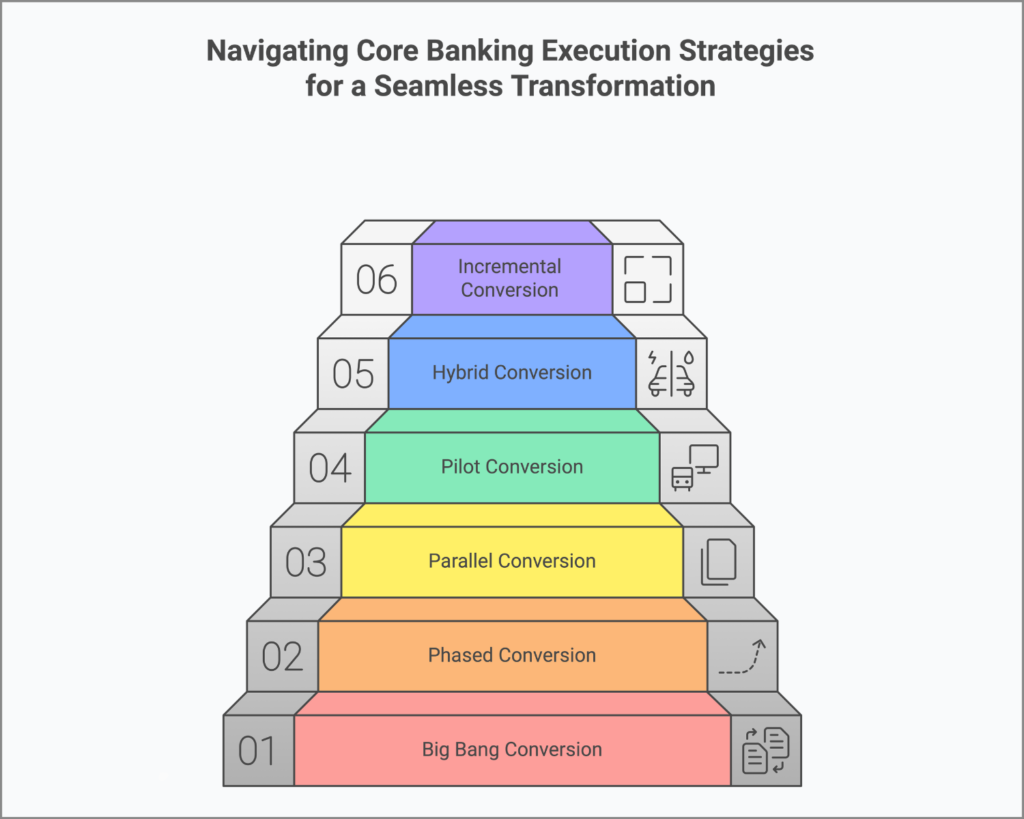

Core Banking Execution Strategies

Understanding your execution options is the first step toward a smoother transformation. Here’s a rundown of six primary strategies:

1. Big Bang Conversion

Switch over all systems and processes to the new platform at once.

2.Phased Conversion

Gradually transition different functions or units over time.

3. Parallel Conversion

Run old and new systems simultaneously to verify the new system before full implementation.

4. Pilot Conversion

Start with a rollout in select areas or branches to test and refine the system.

5. Hybrid Conversion

Combine elements of various strategies to suit specific organizational needs.

6. Incremental Conversion

Slowly replace non-critical systems first, then gradually introduce more complex conversions.

Choosing the Right Strategy

The best strategy for your bank will depend on specific circumstances:

- Big Bang Conversion: Ideal for smaller or less complex environments where quick, complete change is feasible.

- Phased Conversion: Suitable for larger banks with complex systems that require careful change management.

- Parallel Conversion is good for banks that need a safety net to ensure the new system functions perfectly before the complete transition.

- Pilot Conversion: Effective for testing solutions in a controlled, manageable environment before broader deployment.

- Hybrid Conversion: Useful for organizations needing customized solutions possibly due to diverse department readiness levels.

- Incremental Conversion: This is best for minimizing risks by implementing changes gradually, starting with less critical systems.

Advantages and Challenges

Each strategy has its merits and obstacles:

- Big Bang Conversion can dramatically transform operations overnight but poses significant risks if things go awry.

- Phased Conversion reduces immediate risk by spreading changes over time, allowing for adjustments but can prolong total project time.

- Parallel Conversion provides a backup as the old system runs until the new one proves reliable, though it can be costly and complex.

- Pilot Conversion offers insights and potential course corrections with minimal risk but might only reveal some challenges that will arise at full scale.

- Hybrid Conversion tailors to specific needs but requires meticulous planning and management.

- Incremental Conversion offers the least risk regarding system failures but may extend the transformation process.

Moving Forward

Selecting the right execution strategy for your core banking transformation can determine the success of your project. Upcoming articles will delve deeper into each strategy, examining its contexts, benefits, and challenges and providing actionable insights.

What’s Next?

Stay tuned as we dive deeper into each execution strategy, offering detailed insights into best practices, common pitfalls, and practical tips for successful implementation. Whether you’re at the beginning of your transformation journey or refining ongoing efforts, our series will provide the knowledge you need to navigate this complex landscape confidently.

- Execution Strategies Infographic: Explore our comprehensive infographic covering execution strategies for core banking transformations.

- Next Spoke Article: Continue with the next spoke in our series to gain deeper insights into effective transformation execution.

- Conversion Strategies Hub: Visit the for a complete overview of all available strategies and resources.Conversion Strategies Hub

These links will guide you to the next level of understanding and ensure you’re well-prepared for every step of your transformation journey.

#CoreBankingTransformation #ExecutionStrategy