Finding synergy: Balancing operational stability, transformative adaptability, and innovative foresight in core banking transformation.

Navigating Core Banking Transformations:

Why Balancing Operations, Change, and

Innovation Is a Rare Feat

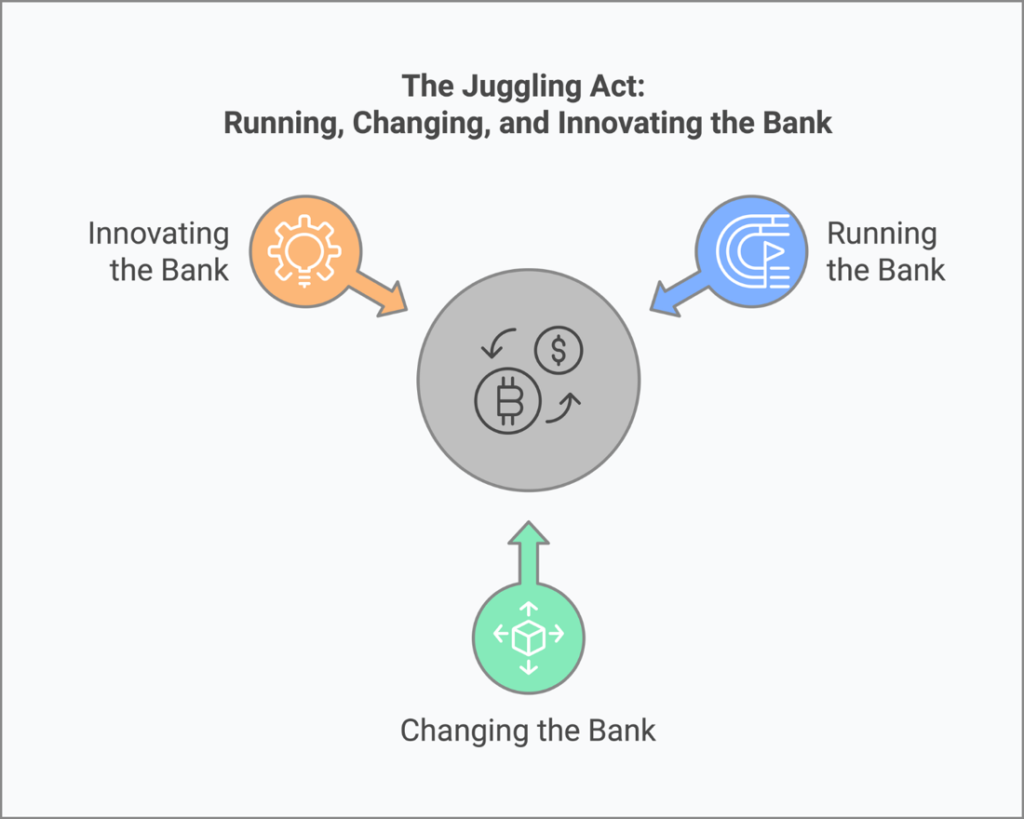

Have you ever tried juggling three balls while riding a unicycle? Neither have we, but we imagine it feels a lot like trying to run, change, and innovate a bank all at once. In today’s fast-paced banking world, we’re tasked with not just keeping the lights on but also adapting to new regulations and pioneering innovations—all simultaneously. But why is it so rare and difficult to excel in all three areas at the same time?

Let’s dive into the complexities of core banking transformations and explore how we can navigate these challenges together.

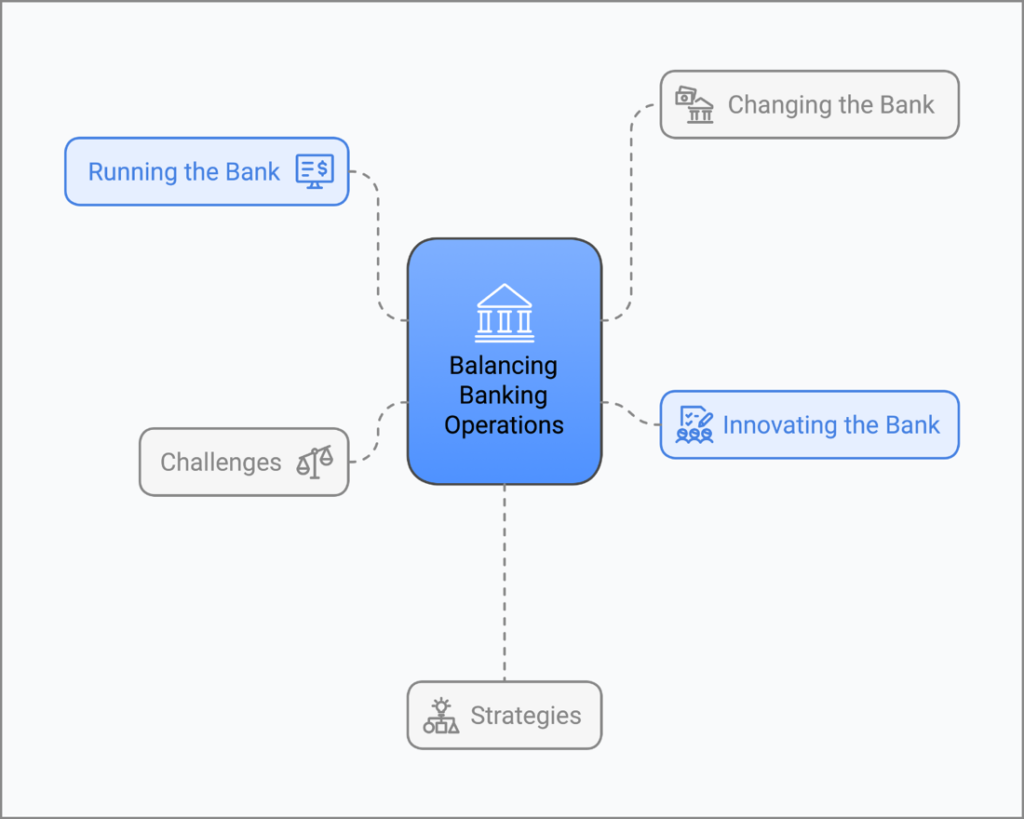

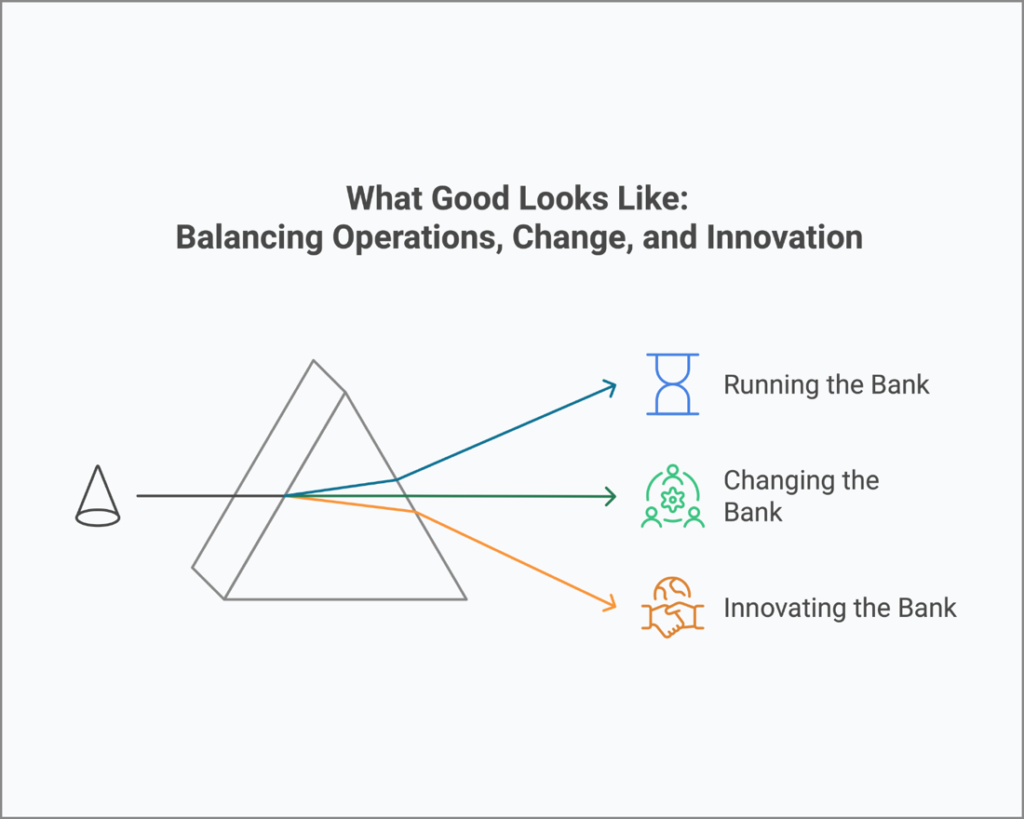

The Balancing Act of Core Banking

Imagine you’re the captain of a massive ship. Running the bank is like maintaining the ship’s current course—steady and reliable. Changing the bank involves adjusting the sails to new winds—flexible and responsive. Innovating the bank is charting entirely new waters—bold and visionary. Each requires a different mindset, and trying to do all three at once can make even the most seasoned captain feel overwhelmed.

Why Can’t One Team Do It All?

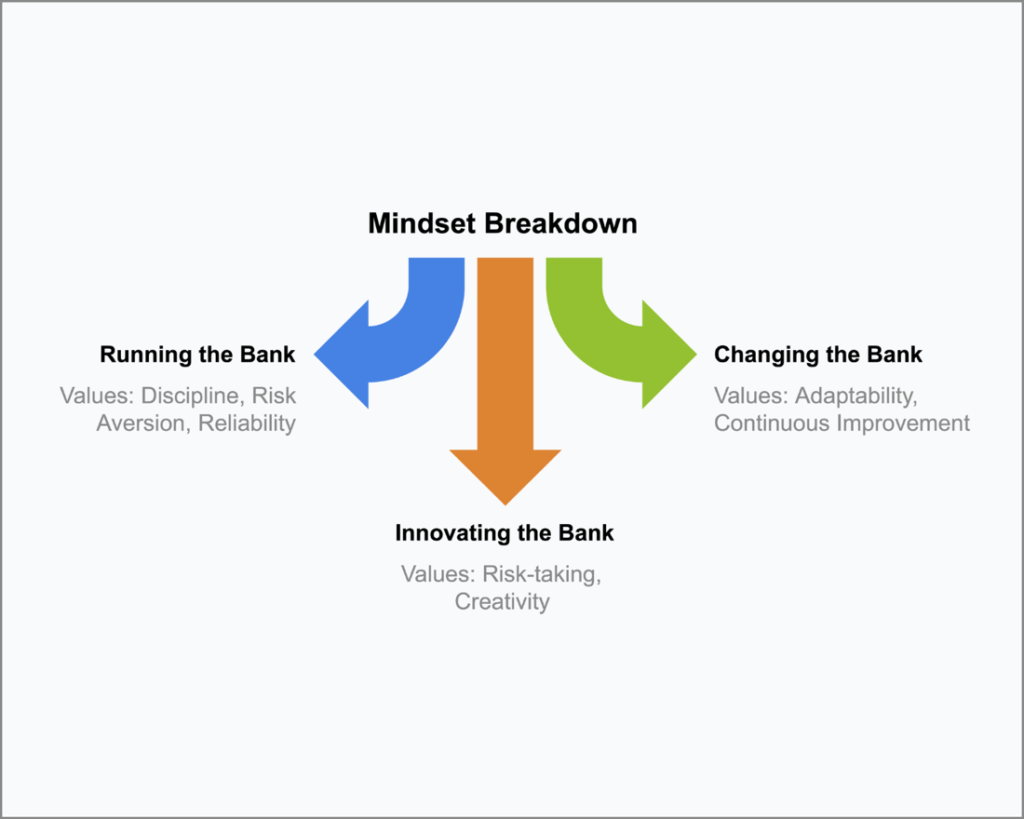

You might wonder, “Why can’t we have one super team handle everything?” Well, it’s not that simple. Each area demands unique values, attributes, and skills. Expecting the same individuals to excel across all fronts is like asking a sprinter to also be a marathoner and a high jumper. While they’re all athletes, each discipline requires specialized training and strengths.

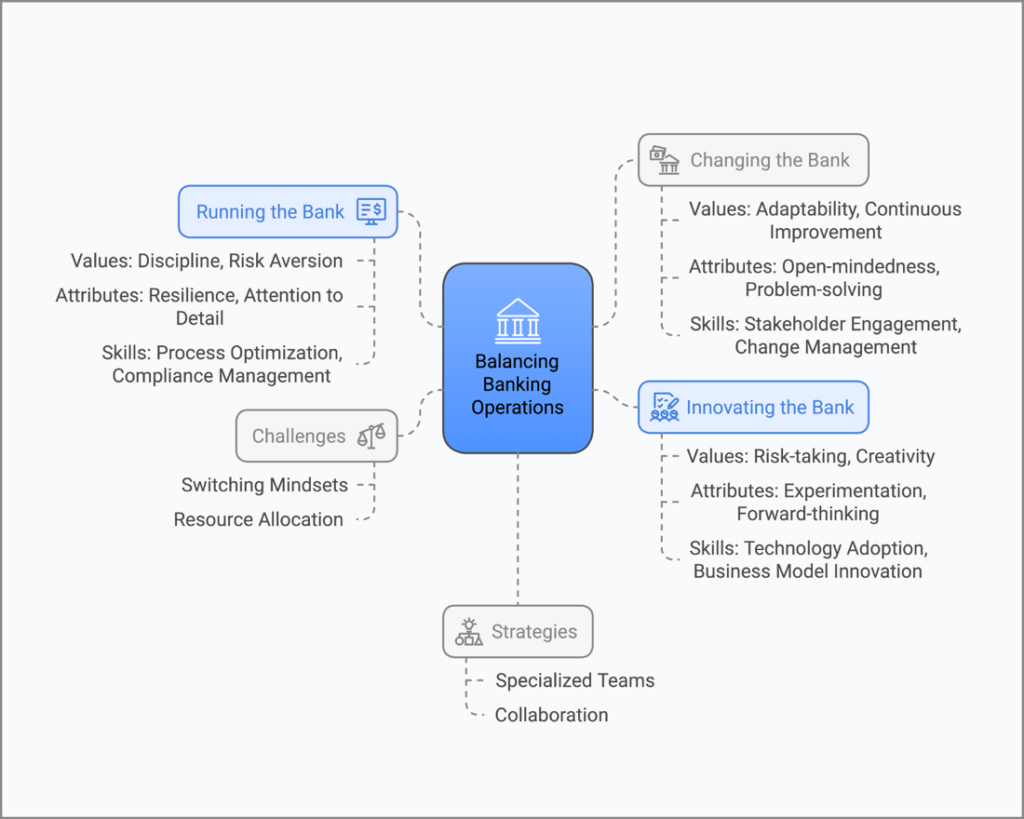

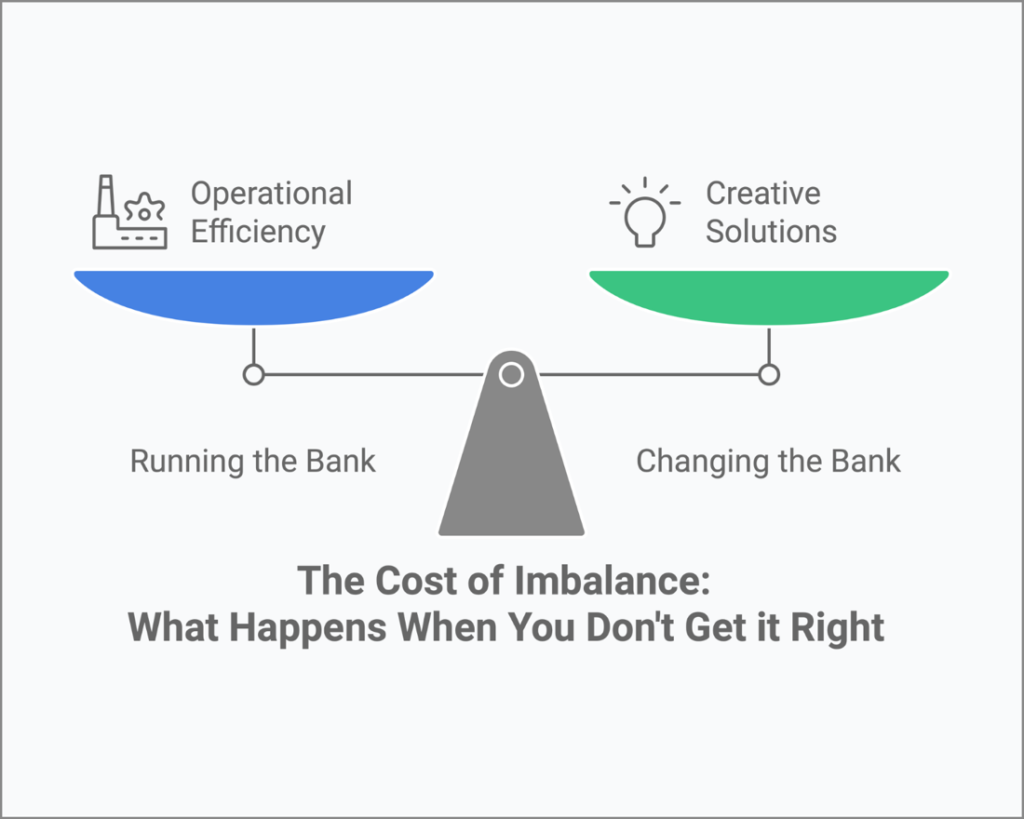

Running the Bank: The Steady Hand

When it comes to running the bank, stability and discipline are paramount. We’re talking about ensuring operations are smooth, efficient, and compliant with all regulations. The focus here is on consistency and minimizing risk.

- Values: Discipline, Reliability, Risk Aversion

- Attributes: Attention to Detail, Resilience, Precision

- Skills: Process Optimization, Compliance Management, Cost Control

Think of these team members as the meticulous watchmakers of our organization. They ensure every gear is turning perfectly. Asking them to suddenly embrace uncertainty and risk is like asking a fish to climb a tree.

Changing the Bank: The Agile Adapters

Change is inevitable, especially in banking. New market dynamics, regulations, or customer expectations require us to adapt. Changing the bank involves a mindset focused on transformation while keeping the ship afloat.

- Values: Adaptability, Agility, Continuous Improvement

- Attributes: Courage, Open-mindedness, Problem-Solving

- Skills: Change Management, Stakeholder Engagement, Communication

These are our agile adapters, the ones who aren’t afraid to disrupt the status quo. They thrive on solving new problems but might find the routine of daily operations stifling.

Innovating the Bank: The Visionaries

Innovation is about pioneering new territories—be it adopting emerging technologies like AI and blockchain or creating new business models. It requires a visionary mindset focused on long-term growth and experimentation.

- Values: Creativity, Risk-Taking, Forward-Thinking

- Attributes: Vision, Experimentation, Resilience to Failure

- Skills: Design Thinking, Technology Adoption, Business Model Innovation

Our innovators are comfortable with ambiguity and see failure as a learning opportunity. But put them in charge of routine processes, and they might feel like they’re wearing a straitjacket.

The Challenge of Switching Gears

Have you ever tried to switch from driving a car to piloting a plane? That’s what it can feel like to switch between running, changing, and innovating the bank. Each requires not just a shift in tasks but a fundamental change in values and skills.

A risk-averse operations leader may struggle with the uncertainties inherent in innovation. Conversely, a visionary innovator might find the structured environment of daily operations suffocating. It’s not about competence but about the alignment of one’s strengths with the task at hand.

Values, Attributes, and Skills: The VAS Framework

To illustrate why distinct teams are crucial, let’s break down the Values, Attributes, and Skills (VAS) for each pillar:

| Pillar | Values | Attributes | Skills |

| Running the Bank | Discipline, Reliability | Attention to Detail, Resilience | Process Optimization, Compliance, Cost Control |

| Changing the Bank | Adaptability, Agility | Courage, Problem-Solving | Change Management, Stakeholder Engagement |

| Innovating the Bank | Creativity, Risk-Taking | Vision, Experimentation | Design Thinking, Technology Adoption |

As you can see, each area demands a unique set of qualities. It’s rare to find someone who embodies all these traits equally. It’s like expecting a chef to master Italian, Japanese, and French cuisine simultaneously—possible, but incredibly challenging.

The Rarity of Versatility

Versatility is valuable, but even the most adaptable individuals have their limits. Overloading teams with multiple responsibilities can lead to inefficiencies and burnout. We’ve seen it happen: a team stretched too thin ends up not excelling in any area.

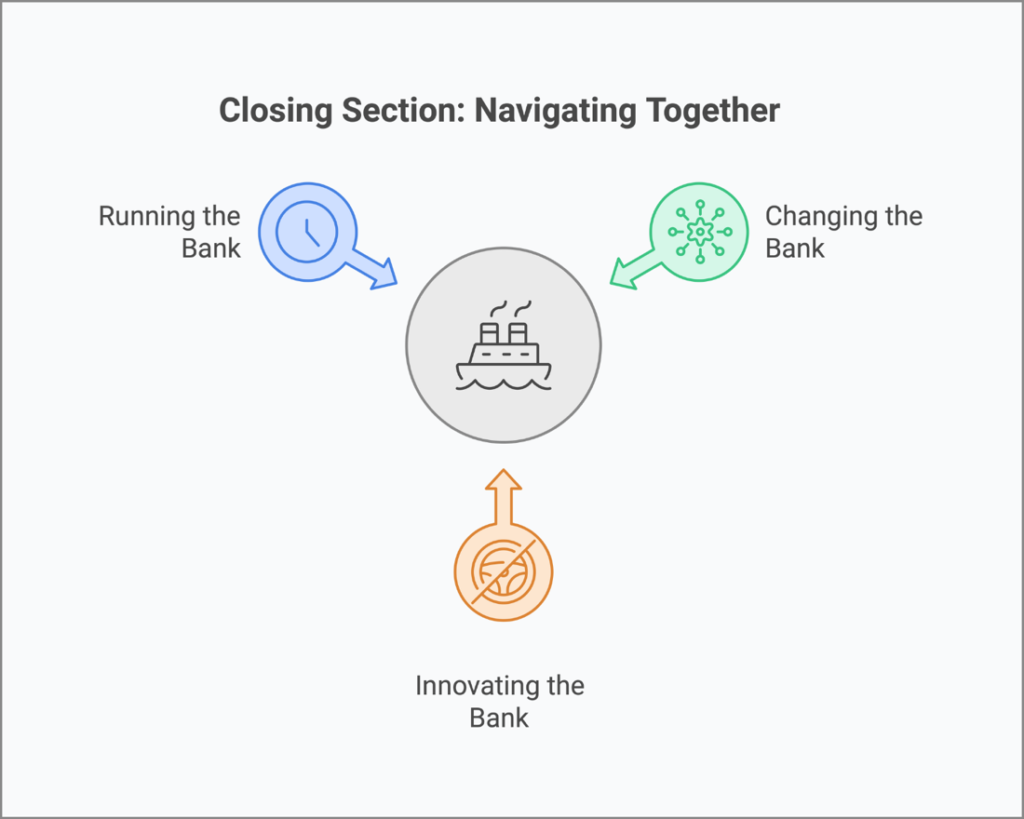

Navigating the Challenges Together

So, how do we navigate these complexities? By recognizing the need for specialization. Separate, dedicated teams should focus on each strategic imperative—running, changing, and innovating the bank.

When we underwent our last core banking transformation, we saw firsthand how specialized teams made all the difference. Our operations team kept everything running smoothly, the change team managed the transition effectively, and the innovation team explored new technologies that set us apart from competitors.

Your Role in the Transformation

You might be asking yourself, “Where do I fit into all of this?” Whether you’re part of the steady operations, the agile change management, or the visionary innovation team, your role is crucial. Understanding the unique challenges and mindsets required for each area helps us collaborate more effectively.

Consider this: Are you more comfortable with routine and precision, or do you thrive in uncertain, rapidly changing environments? Recognizing your strengths allows you to contribute where you can make the most impact.

Embracing a Growth Mindset

Change and innovation can be daunting, especially when they disrupt the familiar routines we’re used to. But embracing a growth mindset means viewing these challenges as opportunities for development rather than obstacles.

Remember when we first introduced mobile banking? It was uncharted territory, and there were doubts and fears. But by embracing the change, we not only kept up with industry trends but also enhanced our customer experience significantly.

Looking Ahead: A Collaborative Future

Navigating core banking transformations isn’t about choosing between running, changing, or innovating the bank—it’s about integrating all three through specialized teams working collaboratively. By acknowledging the distinct roles and valuing each team’s contributions, we create a more resilient and forward-thinking organization.

We live in a time where banking is no longer just about numbers; it’s about adaptability, foresight, and innovation. By focusing on our strengths and working together, we can not only meet the challenges ahead but also set new standards in the industry.

Charting the Course Together

Balancing the demands of running, changing, and innovating the bank is indeed a rare and difficult feat, much like juggling while riding a unicycle. But by recognizing the unique values, attributes, and skills required for each area, we can assign the right people to the right tasks.

Let’s not expect one person or team to be everything to everyone. Instead, let’s value the specialists—the steady hands, the agile adapters, and the bold visionaries—and harness their strengths. Together, we can navigate the complexities of core banking transformations and chart a course toward a successful and innovative future.

So, are you ready to embrace your role in this journey? We certainly are, and we look forward to navigating these exciting waters with you.

Found this article interesting? Want a deeper dive? Check out our book on how to create the Strategic Flywheel or, Continue reading some of our articles

- The strategic trinity: Understanding the distinctions between running, changing, and innovating the bank

- Running the bank -The foundation of operational excellence

- Changing the bank – Adapting to evolving market dynamics

#CoreBankingTransformation #RunChangeInnovateTheBank