Mastering regulatory compliance in core banking transformation ensures operational stability, customer trust, and long-term success.

TL;DR – Navigating Regulatory Compliance: How to Stay Ahead in a Complex Legal Landscape

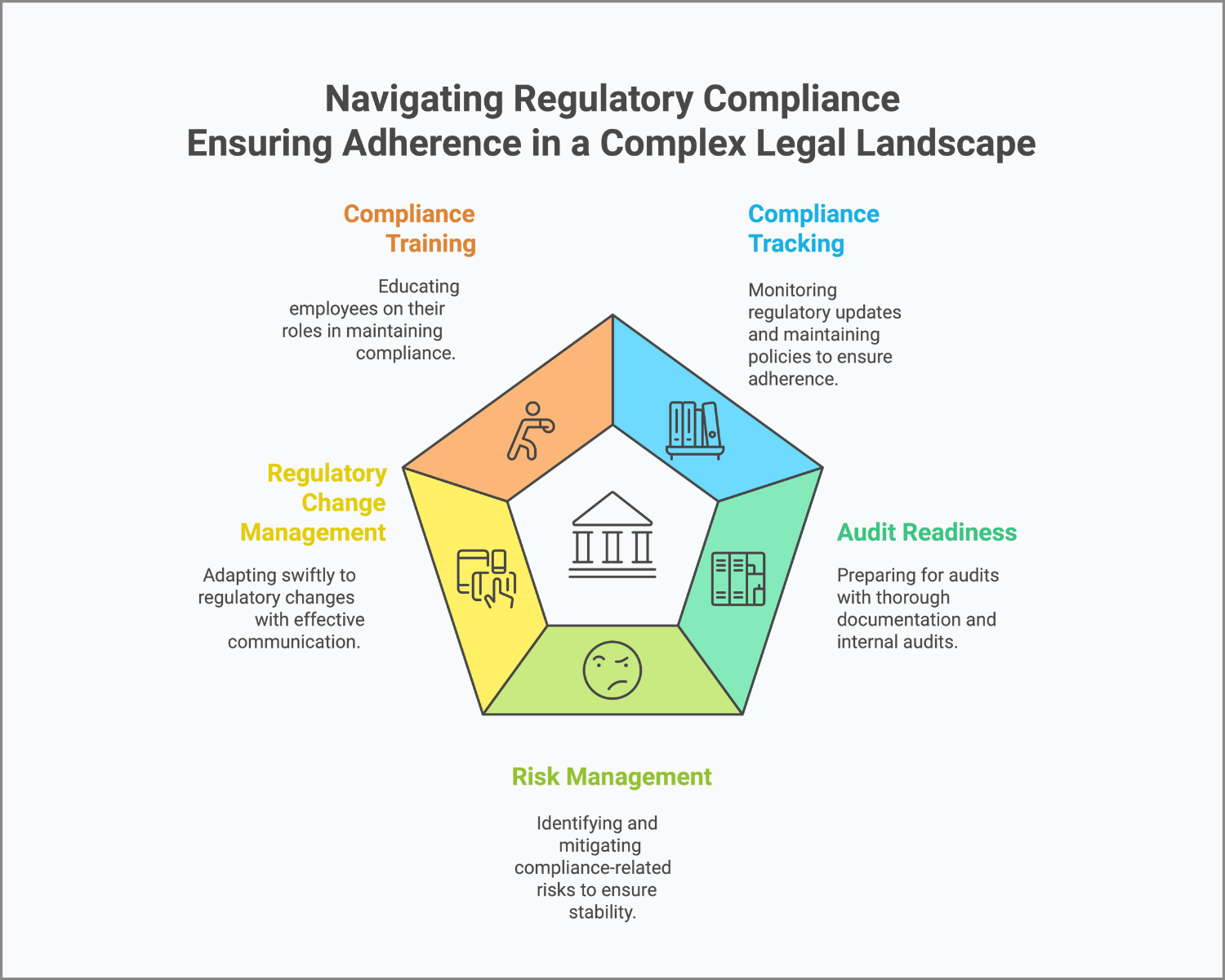

- Master Regulatory Change Management – Stay proactive, not reactive, by tracking evolving regulations and updating policies in real time.

- Build Audit-Ready Processes – Simplify audits with organized documentation, internal reviews, and a clear response game plan.

- Leverage Technology and Training – Use compliance tools and role-specific education to minimize risks and boost team confidence.

- Foster a Compliance-First Culture – From leadership to frontline teams, make compliance a shared responsibility and strategic advantage.

- Why It Matters – Turning compliance into a strength safeguards your bank’s reputation, streamlines transformation, and drives customer trust.

A compliance officer at a regional bank once described their role as “navigating a maze where the walls keep shifting.” Just as they’d think they were in the clear, along came another set of regulations, sending them straight back to square one. Sound familiar? If you’ve ever worked on a core banking transformation, you probably know that feeling too well.

Here’s the reality: regulatory compliance isn’t just a box to tick. It’s the foundation that keeps your transformation (and your bank) safe, steady, and credible. If you ignore it—or even underestimate it—you’re gambling with mega-fines, legal headaches, and a reputation that’s hard to rebuild.

But here’s the good news: getting compliance right doesn’t have to feel like a game of regulatory Whack-a-Mole. With the right mindset, strategies, and tools, you can make compliance work for you—not against you.

Regulatory Compliance in Plain Terms

Let’s strip it down. Regulatory compliance is simply about playing by the rules. For banks, that means following laws and guidelines around things like:

- Anti-money laundering (AML)

- Know Your Customer (KYC)

- Capital requirements

- Data privacy (GDPR, anyone?)

- And the list goes on…

The challenge? Those rules are constantly evolving. And when you’re overhauling your core banking system, every change has ripple effects.

Why It Matters More Than Ever During Core Transformations

Think of compliance like the highway code. Without it, chaos reigns. But in banking, the stakes are higher:

- Legal Consequences: Regulators aren’t issuing polite reminders. Non-compliance can bring serious fines and penalties.

- Customer Trust: Your customers want to know their money and data are safe. Solid compliance gives them confidence.

- Reputation Protection: One bad headline, and you’re on the defensive. Compliance issues often lead to reputational damage.

- Operational Stability: Regulatory frameworks ensure your operations aren’t just running—they’re running safely.

And here’s the upside of getting it right:

- Risk reduction

- Better efficiency (streamlined processes = fewer headaches)

- Competitive edge (customers trust you more)

- Room for compliant innovation (yes, it’s possible!)

The Building Blocks of Effective Compliance in Core Banking Transformation

If you’re steering a transformation, these are the areas you need to get right.

1️. Compliance Tracking

Don’t just keep up—stay ahead.

- Regulatory intelligence: Know what’s coming down the pipeline.

- Policy management: Regularly update internal policies to reflect new regulations.

- Compliance calendar: Never miss a critical deadline.

2️. Audit Readiness

Be ready for the spotlight before it’s pointed at you.

- Documentation: If you don’t document it, it didn’t happen.

- Internal audits: Identify gaps before the regulators do.

- Audit response plans: No scrambling. You’ve got a plan.

3️. Risk Management

Compliance risks don’t go away by ignoring them.

- Risk assessments: Regular and thorough.

- Controls implementation: Practical measures that actually mitigate risk.

- Ongoing monitoring: Risks evolve—so should your monitoring.

4️. Regulatory Change Management

When regulations change (and they will), move fast—without breaking things.

- Impact analysis: Understand how the changes affect you.

- Implementation plans: Have a roadmap. Don’t wing it.

- Stakeholder communication: Everyone needs to be on the same page.

5️. Compliance Training & Awareness

People are your first line of defense—and sometimes your weakest link.

- Regular training: Not once a year. Ongoing.

- Role-specific learning: Relevant to the work they’re doing.

- Continuous awareness: Make compliance part of the culture, not just a policy.

Best Practices for Staying Ahead of Regulatory Complexity

You don’t need an army—you need a plan.

Build a Strong Compliance Program

- Dedicated compliance team: Experts who know their stuff.

- Clear policies and procedures: And enforcement to back them up.

- Leadership buy-in: If the C-suite isn’t on board, it won’t work.

Leverage Technology

- Compliance management tools: Automate the boring stuff, track everything.

- Data analytics: Spot risks before they turn into problems.

- Automation: Reduce manual errors. Free up your team to focus on strategy.

Foster a Culture of Compliance

- Tone from the top: Leaders set the pace.

- Open communication: Safe spaces for raising concerns—without fear.

- Recognition and rewards: Celebrate employees who champion compliance.

Engage with Regulators

- Stay proactive: Regulators like it when you keep them informed.

- Join industry groups: Stay informed and contribute to shaping new regulations.

- Feedback loops: Share insights that can influence policy—collaboration works both ways.

Commit to Continuous Improvement

- Regular reviews: What worked last year might not cut it today.

- Adaptability: Be ready to pivot your compliance strategies.

- Learning mindset: Look at what others are doing (and where they went wrong).

Why Compliance Is Key to Core Banking Transformation Success

Here’s the truth: no matter how innovative your new system is, if you ignore compliance, it’s like building a skyscraper on sand.

Compliance ensures:

- You avoid nasty surprises like fines or shutdowns.

- Smooth implementations, because you’re building with the rules in mind.

- Customer confidence, which is critical during big changes.

- Operational continuity, avoiding delays or disruptions.

- Strategic alignment, keeping you focused on long-term goals.

Ignore compliance, and you risk:

- Massive fines

- Legal headaches

- A tarnished reputation

- Delays in your transformation project

- Losing your license to operate (yep, it’s happened)

A Success Story: Compliance as a Competitive Advantage

Remember that regional bank from the start of this article? After a near-miss with compliance fines, they turned things around—fast. They didn’t just patch holes; they revamped their entire compliance program. They invested in monitoring tools, made training a priority, and created a feedback loop that worked.

The result? Not only did they avoid future penalties, but they also gained efficiencies across the board. Their transformation stayed on schedule, and they became known as one of the most trusted banks in their region.

They learned a key lesson: Compliance isn’t a burden—it’s a business advantage.

What’s Next?

If you’re leading a core banking transformation (or about to start one), now’s the time to check your compliance game.

Take the Core Banking Transformation Readiness Assessment

It’s quick. It’s comprehensive. It’ll show you exactly where you stand and where to focus next.

Final Thought

Compliance isn’t just about avoiding fines. It’s about building a bank your customers—and regulators—can trust. When you get it right, everything else gets a whole lot easier.

#CoreBankingTransformation #CoreBankingReadiness