Strengthening security and data privacy is essential for a successful core banking transformation, ensuring compliance, customer trust, and operational integrity.

TL;DR – Strengthening Security and Data Privacy: Protecting Your Bank and Customers in the Digital Age

- Implement Robust Data Encryption – Utilize advanced encryption technologies to safeguard sensitive information against unauthorized access.

- Adopt Comprehensive Security Protocols – Establish stringent access controls and regular audits to maintain data integrity and compliance with international standards.

- Ensure Regulatory Compliance – Stay updated with evolving data protection laws, such as GDPR, to avoid penalties and build customer trust.

- Invest in Employee Training – Educate staff on security best practices to prevent breaches resulting from human error.

- Enhance Customer Confidence – Demonstrating a commitment to data privacy fosters trust and loyalty among clients.

By focusing on these strategies, banks can effectively protect themselves and their customers in the digital age.

Have you wondered what bankers lie awake at night thinking about? I once had a very frank discussion with a CIO whose bank almost fell victim to a clever phishing attack. Thankfully, they caught it quickly, but it proved a severe eye-opener. In our digital-first world, security and data privacy are more than an issue for the IT department; they’re the very issue of your bank’s survival.

Any core transformation in banking should be all about data security and privacy. One security breach can dent customer trust, attract heavy penalties, and damage your brand for life. In this article, we deep-dive into why security and data privacy are more crucial than ever, detailing ways to strengthen your defenses and ensure your bank and customers are well-protected.

Understanding Security and Data Privacy

Whereas the general definition of security would mean protecting systems, networks, and data from cyber threats and unauthorized access, the main focus of data privacy is the responsible handling of personal data.

Why Are They Important?

Imagine your bank as a fortress. Without solid walls and watchful guards, no one is safe from invasion. The real world has higher stakes:

- Evolving Cyber Threats: There’s a constant development of how hackers breach one’s defenses.

- Relentless Regulatory Scrutiny: Regulations such as GDPR and CCPA advocate for compliance with heavy fines in case of a slip-up.

- Fragile Customer Trust: A data leak will make your customers flee from you and probably never return.

On the other hand, when you take security and privacy seriously:

- Protection of Assets: Keep financial and data assets safe from theft and corruption.

- Regulatory Compliance: Address all legal aspects to avoid financial penalties.

- Trust Building: Reinforce customer loyalty by ensuring their data is safe.

- Innovation Enablement: A secure environment allows for the safe exploration of new technologies.

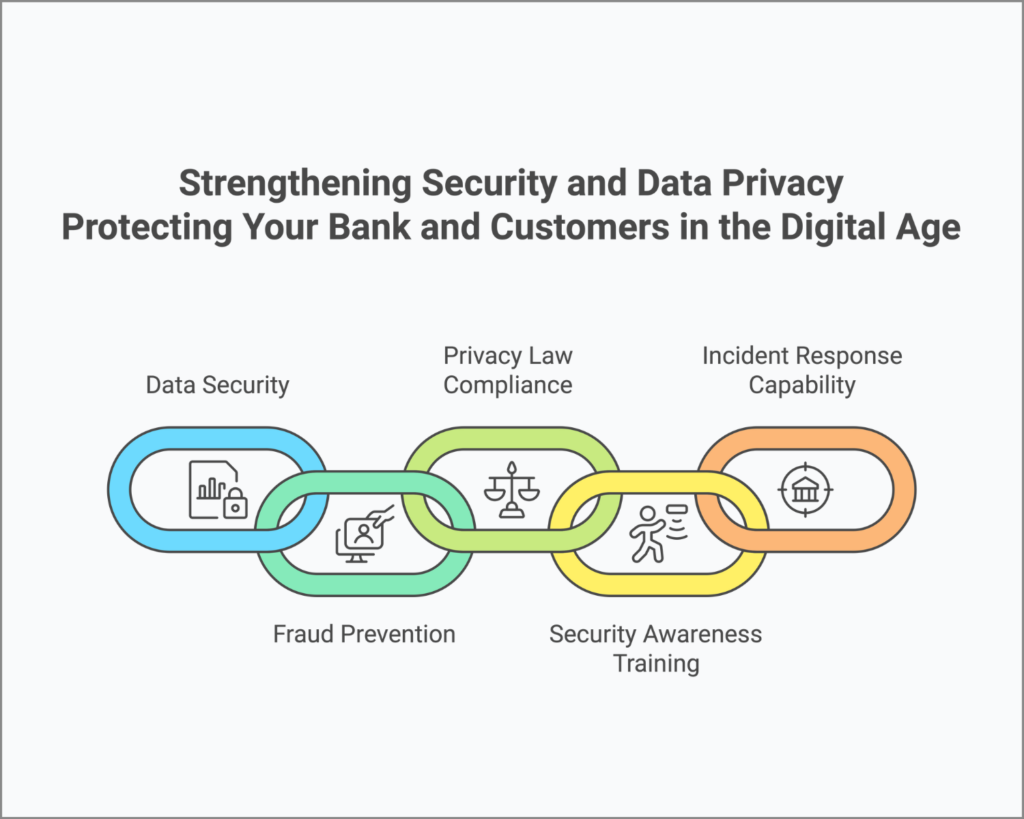

Critical Components of Security and Data Privacy

There are several key areas you can enhance your bank’s security and data privacy:

1. Data Security

Keep data protected across its lifecycle.

- Encryption: Make sure data is secure at rest and in transit.

- Access Controls: Users can be assigned roles, and only those designated can access specific data.

- Secure Authentication: Enhance your security with MFA.

2. Fraud Prevention

Stay ahead of fraudsters with the most progressive strategies.

- Transaction Monitoring: Apply real-time analytics to recognize patterns of unusual activity.

- Behavioral Biometrics: Avail cutting-edge technologies that show abnormal user behavior.

- Collaboration with Authorities: Work with law enforcement to stay current on the latest threat tactics.

3. Privacy Law Compliance

Master the ever-complex landscape that privacy laws pose today.

- Comply with and Understand Applicable Laws: Understand all applicable laws, such as GDPR and CCPA, but not limited to them.

- Data Minimization means collecting data only when necessary for specific business operations.

- Consent Management: Ensure customers consent explicitly to how the data will be used.

3. Security Awareness Training

Empower your workforce to be your first line of defense.

- Regular Training: Impart continuous security training.

- Phishing Simulations: Test the preparedness of your staff by simulating cyber-attacks.

- Policy Updates: Keep everybody updated with the latest security policies and best practices.

4. Incident Response Capability

Be well prepared for quick and sufficient response in case of security breaches.

- Incident Response Plan: Lay down a plan of operations in case of different types of security breaches.

- Response Team: Have a dedicated team managing the breach.

- After-Incident Review: Learn from a breach to prevent future and more robust defenses.

Best Practices for Strengthening Security and Data Privacy

Implementation of the following strategies will increase your defenses significantly:

1. Carry Out a Comprehensive Risk Assessment

- Identify Critical Assets: Know which assets need the most protection.

- Vulnerability Assessment: Know your weak points.

- Prioritize Risks: Deal with the most sensitive security risks first.

2. Adopt a Layered Security Approach

- Multiple Defense Layers: Implement firewalls, intrusion detection, and anti-virus.

- Segment Your Network: Isolate critical data to restrict its impact in case of breach.

- Keep Systems Current: Automate or regularly update all software to defend against known vulnerabilities.

3. Establish Strong Governance

- Security Policies: Craft comprehensive policies for handling data and responding to security events.

- Compliance Checks: Periodically validate your practices against security policy compliance.

- Vendor Management: Third-party vendors should be held to your organization’s security standards.

4. Foster a Security-Conscious Culture

- Leadership Involvement: Encourage executives to sponsor and participate in security activities.

- Report Suspicious Activity: Provide an easy way for employees to report anomalies without persecution.

- Incentivize Vigilance: Reward proactive security behaviors among the staff.

5. Prepare for Potential Breaches

- Simulate Attacks: Regularly test your incident response with simulated breaches.

- Develop Business Continuity Plans: Ensure your bank can operate under adverse conditions.

- Communicate Effectively: Have clear plans for internal teams and external stakeholders in case of a breach.

The Impact on Transformation Success

By focusing on security and data privacy, you protect not just your bank but also create a secure bedrock on which you can build your core banking transformation:

- Decreased Risks: Proactive measures reduce the likelihood and impact of breaches.

- Assured Compliance: Make sure to stay up to date with regulatory demands to avoid costly penalties.

- Strengthened Customer Trust: Secure practices build client confidence, which is crucial for retaining and attracting business.

- Smooth Transformation Rollouts: Secure environments minimize disruptions during significant system overhauls.

- Sustainable Competitive Edge: Being known for solid security can distinguish your bank in a crowded market.

Ignoring these areas can lead to:

- Financial and reputational: Data breaches may lead to extensive losses and a breakdown in confidence and reputation.

- Operational Setbacks: These are some of the security issues that might cause disruptions in banking services, hence making customers discontented.

- Regulatory Penalties: Failure to observe set laws concerning information privacy can result in critical financial penalties.

A Story of Proactivity

In retrospect, following the near-miss experience, the bank took serious action: a total change in the entire security line-up, top-of-the-line defense technologies, and an organization-wide awareness program. These proactive measures hardened their defenses as much as their culture. Presently, they are considered an industry giant for cybersecurity and have constructed a possible disaster and turned it into a strong testimony of commitment toward security.

Moving Forward

In today’s digital age, enhancing security and data privacy is not just an IT concern—it’s a cornerstone of your bank’s operational integrity and competitive advantage. By taking a proactive approach, you protect your assets and build a foundation of trust that is paramount in the financial industry.

Adequate security and privacy practices are the hallmarks of a trustworthy bank. Committing to these principles safeguards your data, reputation, and future.

Your Next Steps

Are you ready to bolster your bank’s security and data privacy? Our Core Banking Transformation Readiness Assessment offers a comprehensive assessment to help you identify areas for improvement and strengthen your defenses.

Found this article interesting? Check out these three related reads for more.

- The Ultimate Guide to Core Banking Transformation Readiness

- Navigating Regulatory Compliance: Ensuring Adherence in a Complex Legal Landscape

- Elevating Customer Experience: Crafting Journeys That Delight and Retain Customers

#CoreBankingTransformation #CoreBankingReadiness