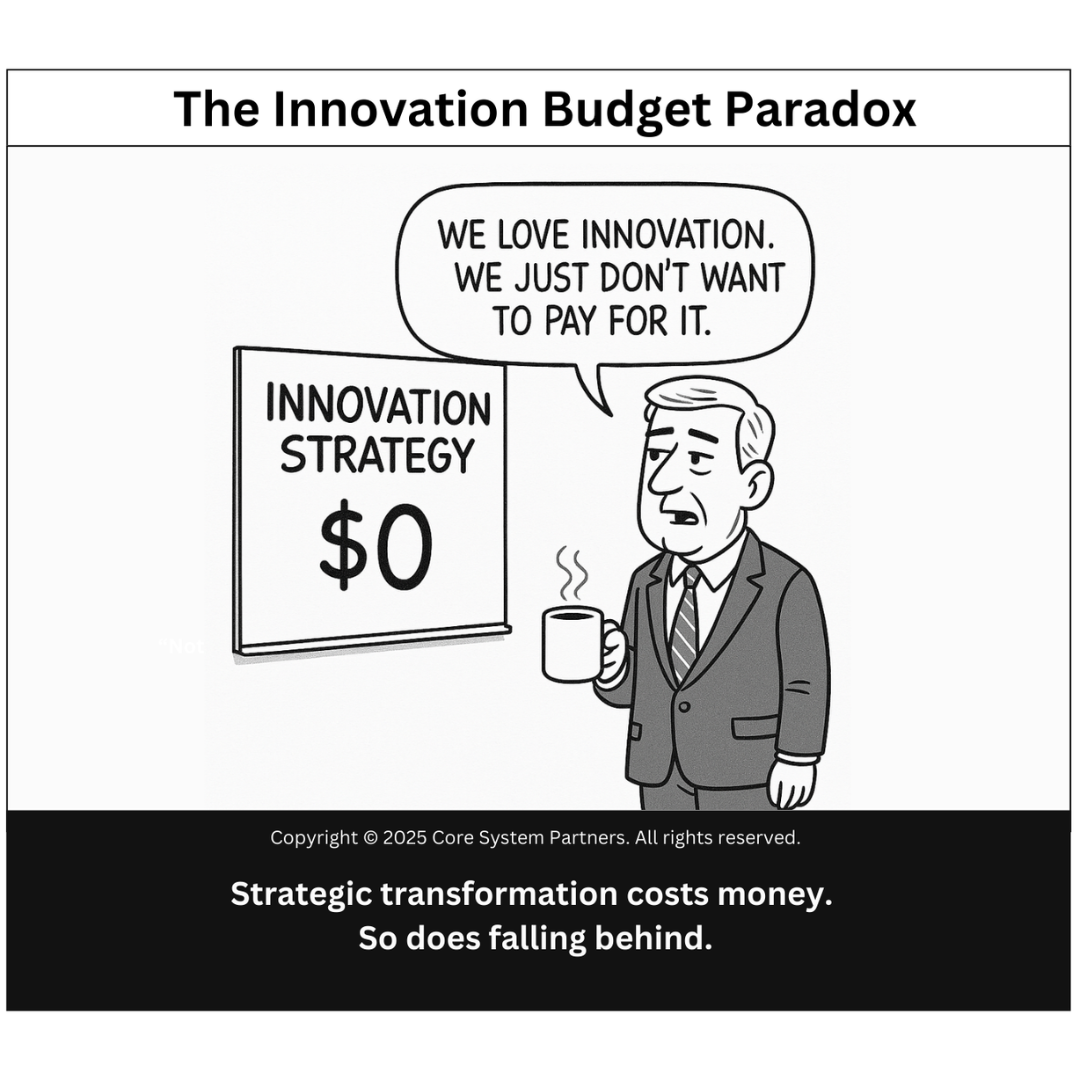

A satirical take on the innovation paradox in banking—everyone wants change, but no one wants to fund it. Strategic progress demands more than lip service.

Ever heard someone say, “We love innovation… we just don’t want to pay for it”?

We have. Multiple times. In fact, that very quote came from a real conversation with a senior exec at a regional bank. He said it half-jokingly—but the results weren’t funny. Two years later, that same bank was still stuck maintaining outdated systems, losing market share to faster, more adaptable competitors.

The cartoon says it all: Innovation Strategy = $0. But here’s the thing—you can’t transform your bank with zero investment. And doing nothing? That costs, too.

Let’s unpack the real tension between ambition and allocation.

We Want Change—Just Not the Invoice

We get it. Budgets are tight. Boards want proof before spending a dime. And innovation feels risky, especially when the payoff isn’t instant.

But here’s the paradox: banks say they want innovation, but then underfund it like it’s a side project.

That approach is like wanting a new house but refusing to pay for the foundation. You’ll get walls—and cracks—fast.

Let’s call it what it is: a disconnect between aspiration and action.

Why This Budget Gap Happens

So, why do banks say one thing and fund another?

Here are a few familiar culprits:

- Legacy Maintenance Drains Everything: “Keep the lights on” eats 70–80% of the tech budget at many institutions. That leaves little left for experimentation or future-forward bets.

- Fear of ROI Uncertainty: Innovation doesn’t always offer linear returns. Leaders hesitate when they can’t show a clean business case upfront.

- Short-Term Pressure > Long-Term Strategy” Quarterly targets win. Long-term transformation gets deferred—again.

- Innovation Is Treated Like a Project, Not a Program: One-off pilots with no follow-through don’t move the needle. But that’s often all the budget allows for.

- No Clear Owner or Incentive: If innovation isn’t baked into leadership goals and compensation, it stays optional.

Sound familiar?

What Underfunding Innovation Actually Costs You

Sidelining innovation doesn’t keep you safe—it just delays the pain. And it often magnifies it. Here’s what banks actually pay for when they choose not to invest:

- Outdated customer experiences: Your digital UX lags. Competitors leapfrog you. Customers leave.

- Slower product rollouts: While you’re refactoring spaghetti code, fintechs are releasing in weeks.

- Rising maintenance costs: Aging infrastructure is expensive to maintain—and gets worse with time.

- Employee frustration and attrition: Top talent wants to build, not babysit outdated tools.

- Missed partnerships: Fintechs and ecosystem players gravitate to banks that are agile and future-ready.

In short: delaying innovation is a strategy—just a losing one.

So What Does a Funded Innovation Strategy Look Like?

It doesn’t mean you need a blank check. But it does require intention, structure, and yes—some real dollars.

Here’s what healthy innovation investment typically includes:

1. Dedicated Innovation Budget

Set aside a real percentage of your tech or transformation budget—aim for 10–20%—to explore, test, and scale innovation initiatives.

2. Innovation Governance

Create a cross-functional team or board to evaluate ideas, approve pilots, and oversee scaling decisions.

3. Innovation-as-a-Service Providers

Partner with fintechs, accelerators, or consulting teams who can help you move faster without hiring every capability in-house.

4. Build vs. Buy Strategy

Decide what to build internally and what to buy or integrate. Be honest about your team’s capacity—and focus on speed to value.

5. Fund Proof of Concepts, Not Just Ideas

It’s easier to greenlight a $100K pilot with measurable outcomes than a $2M unproven platform. Fund fast experiments, not endless presentations.

Case in Point: The Bank That Stopped Saying “Later”

One client we worked with had tried for years to “prioritize innovation,” but it never made it past the whiteboard.

After a particularly rough quarter—two fintech competitors had launched a new product before them—they shifted gears.

The CFO approved a fixed annual innovation fund (separate from core ops), tied to strategic themes: embedded finance, AI-based decisioning, and real-time onboarding. They implemented a quarterly “shark tank” where business units pitched for pilot funding.

Within six months, they had three live initiatives. Within 18 months, one had scaled across the organization and improved digital onboarding NPS by 30 points.

All because they stopped just talking about innovation—and started paying for it.

What You Can Do Next

Not sure where to begin? Here’s a practical checklist to kickstart (and fund) real innovation:

- Audit current spend: How much is allocated to maintenance vs. modernization?

- Identify low-risk, high-value pilot opportunities

- Engage your finance team early—build a business case with clear success criteria

- Set aside a fixed percentage of the budget for exploratory initiatives

- Define what “innovation success” means for your organization—tie it to business outcomes

- Empower teams to act quickly with governance that supports agility, not red tape

Final Thoughts: Innovation Isn’t Free—But Inertia Is Expensive

Innovation may be a buzzword, but it’s not fluff. It’s about staying relevant, competitive, and resilient in a changing market.

The truth is, you’ll pay for innovation one way or another. You can invest in shaping the future—or spend later reacting to it.

So ask yourself:

Are we funding our future, or just managing our past?

Your Next Step

Ready to assess how your organization funds—and prioritizes—transformation?

Take the OptimizeCore® Scorecard.

It’ll help you evaluate whether your strategy, budget, and execution model are truly aligned.

Because the biggest cost isn’t innovation—it’s doing nothing.

#CoreBankingTransformation #CoreBankingOptimization