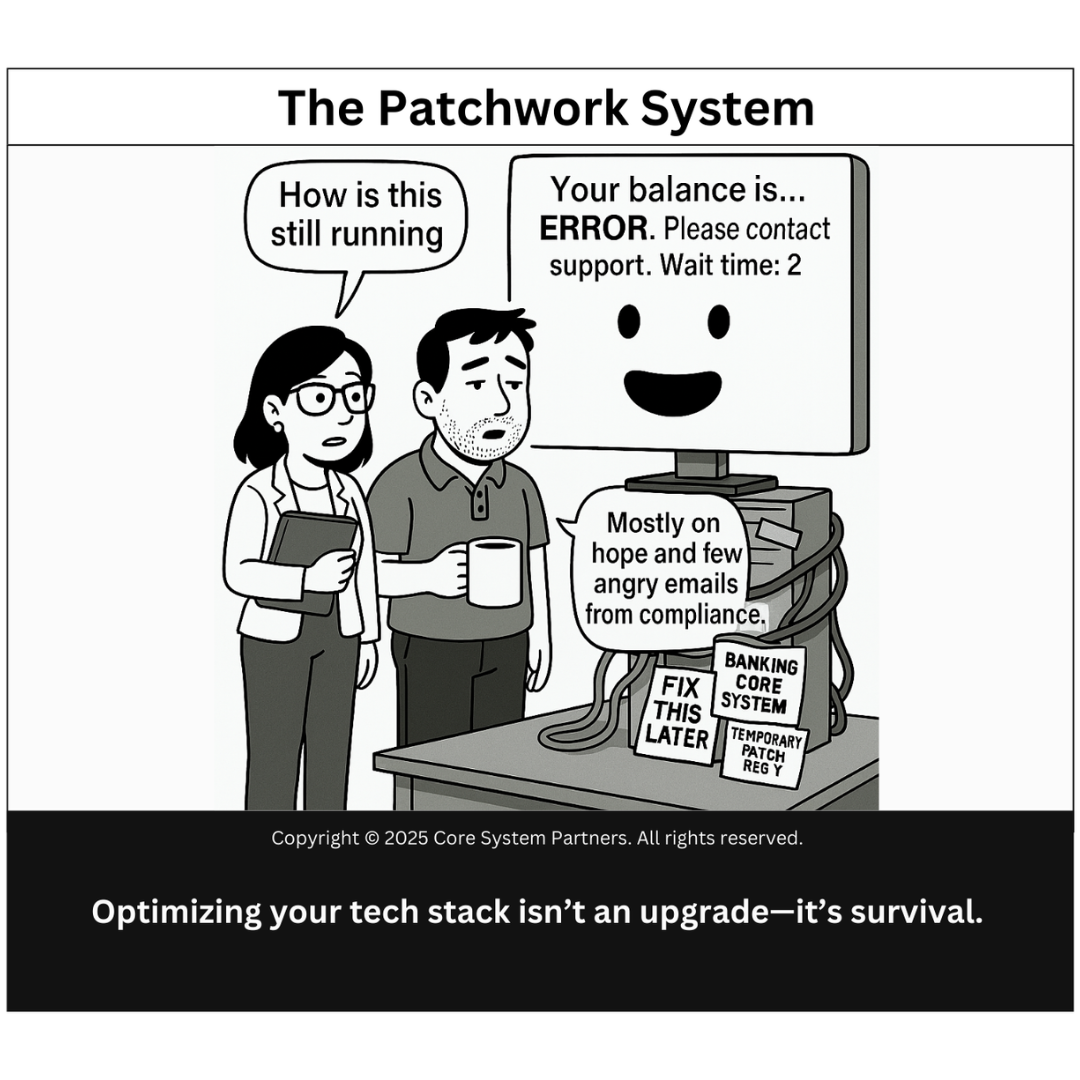

When banking systems run on “hope and angry emails from compliance,” it’s time to rethink your tech stack.

“How is this still running?”

We’ve all asked that question. Maybe it’s during a particularly painful system outage, or when a minor customer query takes five screens and three legacy apps to resolve. The cartoon above captures that moment perfectly—the banking core system, held together by duct tape, deprecated patches, and sheer willpower, grins back as if everything’s fine.

It’s not.

And if your institution is running on a tech stack that feels more like a collection of vintage museum pieces than a strategic asset, you’re not alone. But you are at risk.

Let’s talk about what’s really going on—and more importantly, what you can do about it.

When Legacy Tech Isn’t Just Legacy—It’s Liability

Let’s be honest: legacy systems once worked well. They were state-of-the-art in their time. But that time has passed. What we now see in many mid-size and even large banks is a tangled web of old and newer systems glued together with manual processes, unmaintainable workarounds, and the hope that nobody hits the wrong button.

You may have:

- Batch-processing overnight systems with no real-time visibility

- Data silos that make customer personalization a pipedream

- A “temporary” patch registry older than some of your team members

- Support tickets that start with “I don’t know how it works, but here’s how we’ve been fixing it…”

And yet, somehow, it still runs. Until it doesn’t.

Why the Patchwork Trap Persists

Why do banks stay stuck in this purgatory of perpetual patching? A few common culprits:

- Fear of downtime. No one wants to be the one who hits the kill switch on a system that still “kinda” works.

- Budget hesitancy. Modernization isn’t cheap—but neither is the cost of a major outage or reputational loss.

- Underestimating complexity. Leaders may not realize how deeply embedded legacy systems are in day-to-day operations.

- Band-aid culture. Quick fixes feel productive. They give the illusion of progress. But they don’t solve root problems.

We once worked with a regional bank that delayed modernization for years because “the system still processes transactions.” But when a compliance audit revealed major gaps and a three-day outage occurred during a key market cycle, the conversation changed. Drastically.

What’s Really at Stake?

Here’s the deal: your core technology isn’t just plumbing—it’s your competitive engine.

When you leave it to limp along, you’re accepting:

- Operational inefficiencies that compound daily

- Data inaccuracies that undermine decision-making

- Customer frustration that silently erodes loyalty

- Innovation roadblocks that make AI, automation, and agility out of reach

Meanwhile, your competitors—particularly newer fintechs or digitally-native banks—are not operating with the same friction. They’re faster, leaner, and much more adaptable.

Optimizing the Tech Stack: Where to Begin

So, what does modernization actually look like? It doesn’t mean throwing everything out overnight. Instead, it’s about reimagining your tech stack with clarity and intention.

1. Conduct a Tech Stack Audit

Start with a brutal, honest inventory:

- What systems are still critical?

- What’s duplicative?

- What breaks the most often?

- Where are you most vulnerable (compliance, customer experience, operations)?

2. Prioritize by Business Value

Not all upgrades are created equal. Focus first on areas that:

- Directly impact revenue or customer experience

- Pose the highest compliance risk

- Block innovation initiatives

3. Build for Integration and Modularity

One of the biggest lessons from the patchwork era is this: don’t build another monolith.

Instead:

- Use APIs to decouple systems

- Embrace microservices where possible

- Favor cloud-native and open architecture

As Gartner notes, composable banking systems allow for faster adaptation without overhauling the entire core each time.

4. Don’t Delay Core Modernization

This is the big one. Yes, it’s hard. Yes, it’s expensive. But pushing core modernization further down the roadmap only raises the eventual cost and risk. Modernizing your core enables everything else—from real-time payments to hyper-personalized digital banking experiences.

From Survival Mode to Strategic Mode

Let’s be clear: optimizing your tech stack isn’t just about chasing the latest trends. It’s about survival.

Banks that fail to evolve their infrastructure won’t just move slower—they’ll eventually stop moving altogether.

But those that take the plunge and modernize intentionally position themselves to:

- Move faster

- Innovate confidently

- Delight customers consistently

- Compete sustainably

That same bank we mentioned earlier? Once they embraced the transformation and cleaned up their core stack, they saw a 60% drop in system-related service tickets and a 20% bump in NPS within 12 months. Their IT team finally had time to think proactively instead of constantly firefighting.

The Bottom Line

“Fix this later” may work for leaky faucets. It doesn’t work for core banking systems. The longer we defer meaningful modernization, the more we pile on complexity, cost, and risk.

So next time your team says, “How is this still running?”—take it as your signal. Not to patch. To transform.

Ready to Find Out Where Your Stack Stands?

Take our OptimizeCore® Assessment to uncover where your technology stack is working for you—and where it’s silently working against you.

#CoreBankingTransformation #CoreBankingOptimization