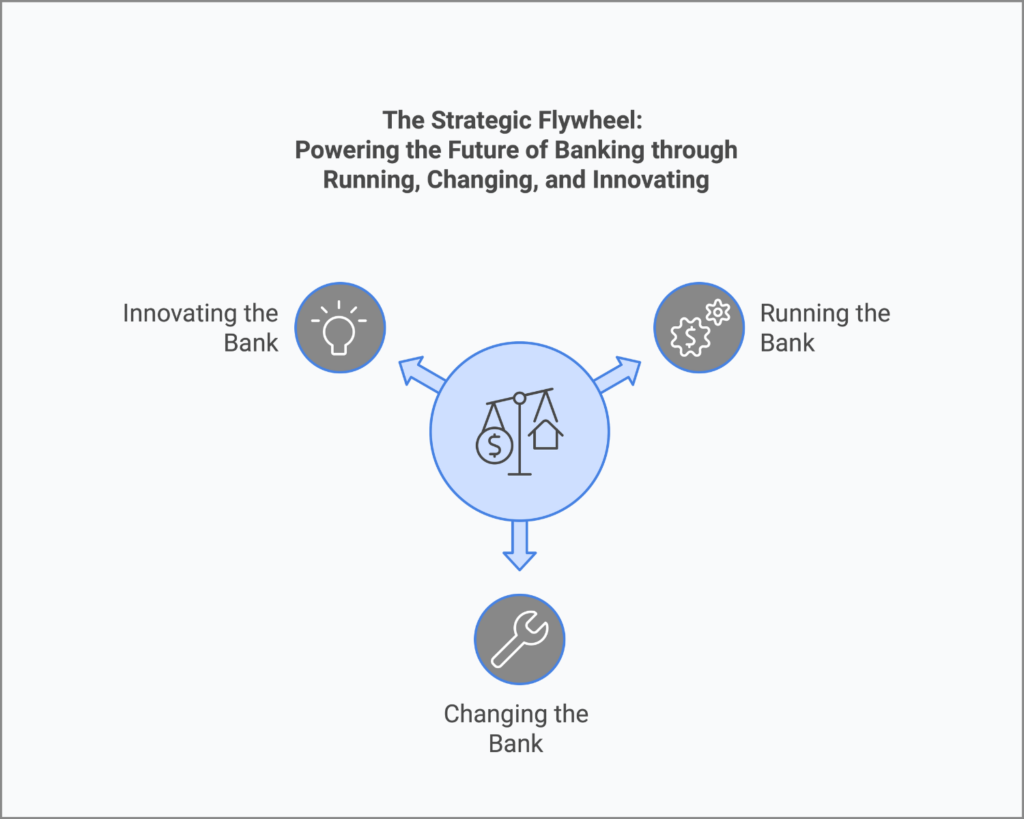

Mastering the strategic trinity in banking: Balancing the acts of running, changing, and innovating to foster growth and ensure sustainability.

The article “The Strategic Trinity: Understanding the Distinctions Between Running, Changing, and Innovating the Bank” delves into the critical roles that banks must balance to remain competitive in today’s dynamic financial landscape.

TL;DR – The Strategic Trinity: Running, Changing, and Innovating the Bank

- Operational Excellence – Maintain seamless daily banking operations to ensure customer satisfaction and trust.

- Transformational Change – Implement strategic initiatives to adapt to evolving market demands and regulatory requirements.

- Innovative Growth – Foster a culture of innovation to stay ahead of fintech disruptions and meet future customer needs.

- Balanced Strategy – Align these three pillars to achieve sustainable success in the competitive banking sector.

Understanding and executing this strategic trinity empowers banks to thrive amid industry challenges.

Of all the common and critical mistakes that leadership can make in the complex world of banking, probably the most common is to expect the same teams responsible for running the bank to lead efforts to change and innovate the bank-all within the same hours of the day. This “do more with less” mentality not only stretches resources thin but also begs for failure. The truth is, running the bank, changing the bank, and innovating the bank are distinctly different strategic imperatives, each needing its own focused expertise and resources.

The banks that don’t recognize the imperative to make this differentiation often find themselves over-extended with burnout, operational inefficiencies, and ultimately an unsuccessful transformation. In order for banks to succeed in today’s competitive landscape, they should understand and welcome these differentiated requests of running the bank, changing the bank, and innovating the bank, and organize themselves accordingly.

The article introduces the concept of the strategic trinity-running, changing, and innovating-of the bank, and for what reasons each of these aspects needs to be treated as a separate but interdependent function. All of these distinctions are very important for banks in their effort of transformation while striving to continue with operational excellence and ensuring innovation.

Running the Bank: Maintaining Operational Excellence

“Running the bank” refers to all of the activities constantly making a bank work day in and day out, including customer transaction processing, regulatory requirements, up-time, access to banking systems, or simply consistent service quality. This is most relevant for operational excellence: dependably high-quality service at low cost and low risk. On the other hand, it is easy to get completely inward-looking in trying to run a bank and therefore miss out on some excellent external opportunities and threats.

Changing the Bank: Adapting to Market Dynamics

“Changing the Bank” covers the strategic activities implemented for changing the Bank’s operation, processes and systems due to fluctuating market dynamics, different regulatory changes, or shifting customer expectations. It can mean process reengineering, upgrading core systems, or even reengineering the organization itself. Adaptability – the bank can change easily and move towards the same direction as the one of the external environment is the most important word here. Change management and clear communication are key components of every transformation, although a culture of continuous improvement plays a very critical role.

Innovating the Bank: Pioneering the Future of Banking

“Innovating the Bank” is beyond incremental change; it is the creation of new value propositions, products, and services that could give the bank marked differentiation from competitors. Innovation concerns research into emergent technologies such as AI, blockchain, and fintech partnerships to create new business models that will enable future growth. Without substantial running and changing of the bank, however, innovation initiatives may not get good traction or yield sustainable outcomes.

The Interplay Between Running, Changing, and Innovating

Each of these three pillars is running the bank, changing, and innovating-separate areas of focus, but all three closely interact. The effective running of the bank provides stability to pursue change initiatives; successful change leads to the ability to innovate with agility. Then again, innovation can bring changes to boost operational efficiency, which in turn makes the bank run more smoothly.

The right balance among these three is critical to success for the banks. That requires clarity in organizational alignment, resources, and dedicated teams for each of these focus areas, supported by leadership that understands how to prioritize and integrate these efforts.

Mindset Matters

Successfully navigating the strategic trinity of running, changing, and innovating the bank requires distinct mindsets for each domain. Running the bank demands a focus on stability, efficiency, and operational excellence, where the goal is to maintain seamless, day-to-day functions with minimal risk. Changing the bank, on the other hand, calls for an adaptive mindset—one that embraces transformation and leads teams through complex, large-scale transitions while managing uncertainties.

Finally, innovating the bank requires a forward-thinking, bold, and creative mindset, constantly seeking out new technologies and ideas to push the boundaries of what’s possible. Few individuals can easily shift between these distinct mentalities, and in many cases, success depends on specialized teams dedicated to each area. In the upcoming articles, we will dive deeper into each mindset, exploring the values, attributes, and skills (VAS) needed to thrive in these roles.

Organizing for Success

The following series burrows deeper into each of these three pillars of Running the Bank, Changing the Bank, and Innovating the Bank to examine their peculiar challenges, opportunities, and best practices. Grasping what makes them different and how they also connect can help banks get organized better toward fulfillment of three major imperatives: attaining operational excellence, active enabling of change, and pioneering the future in banking.

So, stay tuned as we now go into a discussion of how it would be possible for banks to manage this strategic trinity in their positioning for success long-term in an increasingly complex and competitive environment.

Found this article interesting? Want a deeper dive? Check out our book on how to create the Strategic Flywheel or, Continue reading some of our articles

#CoreBankingTransformation #StrategicTrinity