Assessing readiness is key to successful core banking transformation—ensure your organization is prepared across all critical areas before diving in.

The article “The Ultimate Guide to Core Banking Transformation Readiness” provides a comprehensive roadmap for financial institutions preparing to modernize their core banking systems.

TL;DR – The Ultimate Guide to Core Banking Transformation Readiness

- Assess Organizational Preparedness – Evaluate your institution’s readiness for transformation by analyzing current processes, technology, and culture.

- Define Clear Objectives – Establish specific goals and success metrics to guide the transformation journey.

- Develop a Strategic Roadmap – Create a detailed plan outlining the steps, timelines, and resources required for implementation.

- Engage Stakeholders – Involve key personnel across departments to ensure alignment and support throughout the process.

- Mitigate Risks Proactively – Identify potential challenges and develop contingency plans to address them effectively.

By following these steps, banks can enhance their readiness for core banking transformation, leading to improved efficiency and competitiveness.

Have you ever kicked off that critical project, only to find yourself in the middle, realizing that you needed more preparation than you thought?

I remember talking once to the CEO of one regional bank, who related a story that was too familiar: they had acquired the cool new technology and assembled their dream team for their core banking transformation. And expectations through the roof. But as it moved along, one unexpected challenge after another started to crop up: stakeholder resistance, regulatory challenges, integration problems, name it. Delays and budget overruns ensued, and that was when they realized how underthought their organization’s readiness was for such a vast change.

Core banking transformation is so much more than new technology. In today’s world of change, financial customers continue to raise the bar and leave very little room for error. Even the best plans will unwind when a proper understanding of readiness is lacking.

We introduce the Core Banking Transformation Readiness Assessment, which describes ten categories that check preparedness and readiness. Knowing those early helps drive the transformation journey better and assures its long-term success in the organization.

Understanding Transformation Readiness

The readiness for change will only be an institutionalized readiness of your organization to design core planned changes in the banking systems and operations and then implement those changes to sustain them. This is all about a comprehensive view of organizational culture, strategic alignment, technological capabilities, and operational efficiencies, among other things.

Why Is It Important?

- Proactive About Risk: It finds problems early and mitigates them before they have entirely failed a project.

- Efficiency Improvement: Good preparation ensures flow and efficiency within operations.

- Maximize Benefit: Full exploitation of the change realizes customer satisfaction, enterprise agility, and competitiveness.

What Happens Without Adequate Preparation?

- Failure of the Project: Unpreparedness leads to failure in the activities undertaken, wasting time and other resources.

- Operational Stops: Downtime or unplanned failures decrease customer service quality and may destroy the brand’s reputation.

- Non-Compliance With Regulations: inaction to comply will ultimately lead to legal justice against it and, more importantly, loss of customer trust.

- Security Breaches: Poor attention to security opens a door for current cyber threats and data breaches.

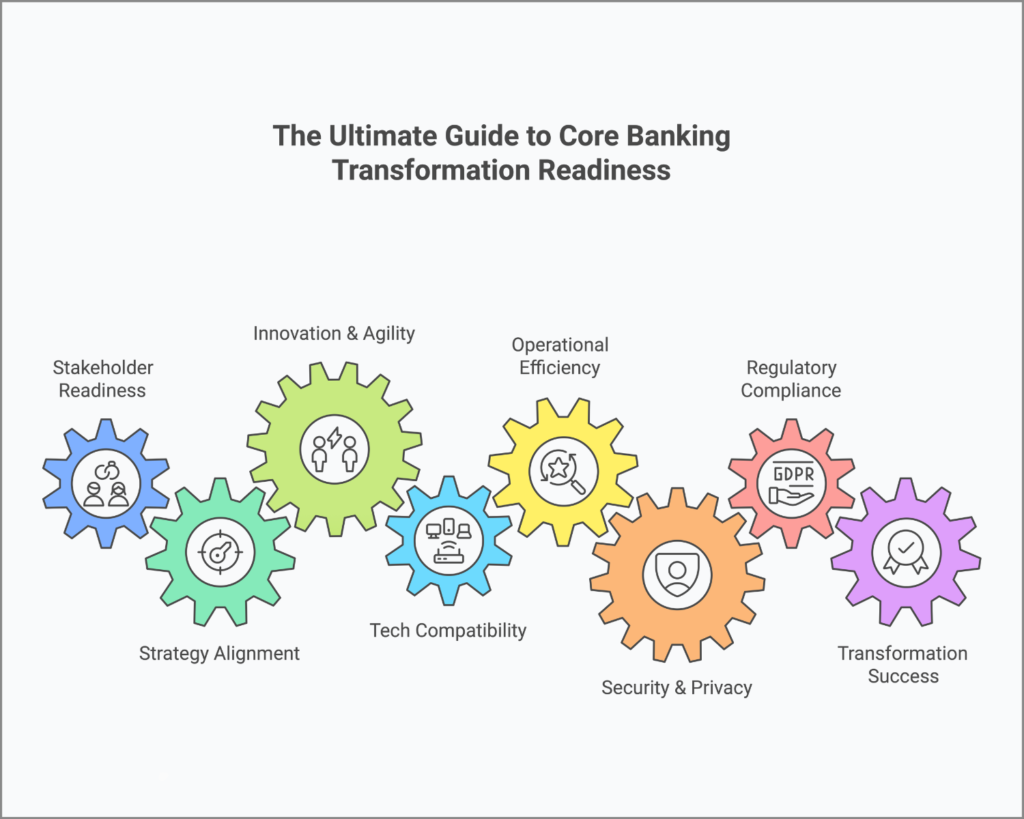

The Ten Key Categories of Readiness

To assess your organization’s readiness, the Core Banking Transformation Readiness Assessment encompasses ten categories:

- Stakeholder Readiness

- Strategy Alignment

- Innovation and Agility

- echnology Stack Compatibility

- Operational Efficiency

- Security and Data Privacy

- Regulatory Compliance

- Customer Experience

- Solution Delivery Capabilities

- Vendor Assessment and Selection

Each of these pieces ensures that your organization covers all of its bases.

Why a Holistic Approach Matters

Each of these categories is interlinked:

- Stakeholder Readiness will drive Solution Delivery Capabilities: Engaged stakeholders will move to support project execution.

- Technology Stack Compatibility can drive Operational Efficiency and Customer Experience. Not operating on legacy systems can significantly hamper processes and the quality of customer service you can offer.

- Security and Data Privacy, Compliant with Regulations: Most regulations have their base as data protection.

Carelessness with any one of them might skew your whole transformation. For instance, not paying enough attention to stakeholder readiness leads to resistance, low morale, and delayed projects. Besides, failure to follow the Security Measures will lead to data breaches, financial loss, and reputation hampering. Lack of proper strategy alignment will lead to a waste of resources and failure to attain objectives regarding business performance.

It aligns all the aspects of an organization, better preparing it for transformation by taking a holistic approach; hence, it enhances the probability of the transformation journey’s success.

Core Banking Transformation Readiness Assessment

Core Banking Transformation Readiness Assessment is a self-diagnostic tool for measuring your organization’s readiness. It clearly shows where one stands and which areas need more attention.

How It Works

- Standardized Questions: All the categories have five questions each, rated on a scale of 1 to 12.

- Equal Weightage: in each category to make an appraisal balanced.

- Actionable Insights: The output focuses on specific points to work on and thus provides a direction for improvement.

Benefits of Self-Assessment:

- Objective Evaluation: It gives a very fair view of your present standing.

- Decision Making: It identifies the areas where one must invest time and resources.

- Reduction of Risk: One can see imminent problems that one might experience so that necessary planning can be done to resolve these problems beforehand.

- Better Communication: Actual proof can be shown for discussion amongst various stakeholders.

Ready to Take the First Step?

Know your readiness; it’s the first step towards a successful core banking transformation. After completing the Core Banking Transformation Readiness Assessment, you will have valuable insights that help planning and execution.

Click here for the Core Banking Transformation Readiness Assessment and view your readiness.

Moving Forward

Reflecting on the ambitious bank CEO’s story, it’s evident that even with significant investment and talent, overlooking organizational readiness can lead to unforeseen challenges. After realizing the gaps, they stepped back and used a comprehensive assessment tool to evaluate their readiness across all critical areas. This allowed them to address weaknesses proactively, align their teams, and adjust strategies. The transformation eventually became a success story, leading to enhanced customer satisfaction, improved operational efficiency, and a stronger market position.

Your organization can achieve similar success by thoroughly assessing your readiness and addressing any shortcomings. Remember, core banking transformation isn’t just about adopting new technology; it’s about evolving as an organization. With the proper preparation, you position yourself to survive the transformation and thrive because of it.

Embarking on this journey without full preparedness is like setting sail without a compass. But with the right tools and insights, you can navigate the complexities and steer your organization toward a prosperous future.

Next Steps

- Dive Deeper: Explore our in-depth articles on each of the ten categories to gain more insights and practical tips.

- Assess Your Readiness: Use the Core Banking Transformation Readiness Assessment to evaluate your organization’s strengths and areas for improvement.

- Consult with Experts: If you need personalized guidance, our team is here to help you navigate your transformation journey.

By understanding your current state and planning your path forward, you can set your organization up for a successful core banking transformation that meets today’s challenges and anticipates tomorrow’s opportunities.

Found this article interesting? Check out these three related reads for more.

- Core Banking Transformation Readiness Assessment

- Mastering Stakeholder Readiness: Engaging Your Team for Transformation Success

- Optimizing Strategy Alignment: Ensuring Your Transformation Drives Business Goals

#CoreBankingTransformation #CoreBankingReadiness