Vol. 1

Connect, Innovate, Elevate

Welcome to Core Insider, your go-to source for the latest insights, strategies, and news in banking transformation. Discover how each small step can lead to powerful transformations in your core banking journey. Don’t wait—unlock the tools and insights that drive real progress!

This week, we’re diving into Pilot Conversions, part of our Run, Change and Innovate the Bank Series and sharing actionable tips on how to 𝗖𝗛𝗔𝗡𝗚𝗘 𝘁𝗵𝗲 𝗕𝗮𝗻𝗸. Plus, don’t miss our curated roundup of global banking news. Let’s get started!

“Tip of the Day” series

Each tip is designed to be actionable, practical, and ready to use. Take a look, print it out, and share it with your team!

Let us know your favorite tip in the comments below—and if you’ve got strategies of your own, we’d love to hear them. Let’s keep the conversation going!

Click here to view in full display the Change the Bank Recap!

Core Banking News

What’s Happening in Core Banking This Week?

Have you ever wondered what goes on behind the scenes when you tap your phone to pay or check your balance online? We’re excited to share some big updates from the world of core banking that will pique your curiosity and shape your daily financial experiences.

ANZ’s $2.5 Billion Leap Forward

Australian banking giant ANZ is making a bold move by investing $2.5 billion to modernize its core systems.

Why so much? Because outdated technology can slow transactions, complicate compliance, and frustrate you. By developing the ANZ Plus platform and Transactive Global system, ANZ aims to:

- Boost efficiency

- Strengthen security

- Simplify digital banking

From migrating 1.2 million Suncorp Bank customers to ANZ Plus by 2027, to building future-ready infrastructure, ANZ is setting a fast pace for the industry. (“It’s like trading in a vintage car for a self-driving electric vehicle,” one analyst quipped.)

European SaaS Solutions Steering the Future

Over in Europe, SaaS-based platforms—like Aura Cloud, five°degrees, Fimple, and Skaleet—are challenging what “modern banking” means. They offer:

- Quicker implementation: Launch new financial products faster.

- Flexible integrations: Adapt to market shifts without massive system overhauls.

- Cost savings: Pay for what you use, and scale as you grow.

Curious? IBS Intelligence has an in-depth feature on how these solutions are transforming European finance.

Smaller Aussie Banks Think Big Through Mergers

Meanwhile, in Australia, smaller banks like Qudos Bank and Bank Australia are considering mergers to compete with larger institutions. This union could mean:

- $17 billion in combined assets

- Enhanced operational efficiency

- A need for advanced core systems to handle the influx of customers

Merging banks must unify data and processes seamlessly. It’s a bit like blending two families into one household—tricky at first, but beneficial once everything’s sorted. You can read more on this in The Australian.

The Future of SaaS in Core Banking

SaaS solutions have emerged as contenders in banking modernization. They let you:

- Automate day-to-day tasks to reduce human error

- Scale operations without inflated hardware costs

- Deliver better customer experiences with faster updates

At a time when financial institutions scramble to innovate, SaaS platforms are becoming potentially game changers. If you’d like the inside scoop, IBS Intelligence offers detailed insights.

Ready for More?

From ANZ’s monumental upgrade to Europe’s SaaS-driven momentum and Australian banks’ quest to merge, we’re seeing a whole new era of streamlined, future-proof banking. As core systems continue to evolve, you’ll likely enjoy faster transactions, smoother digital experiences, and financial services that keep up with your needs.

Click here to read the full articles!

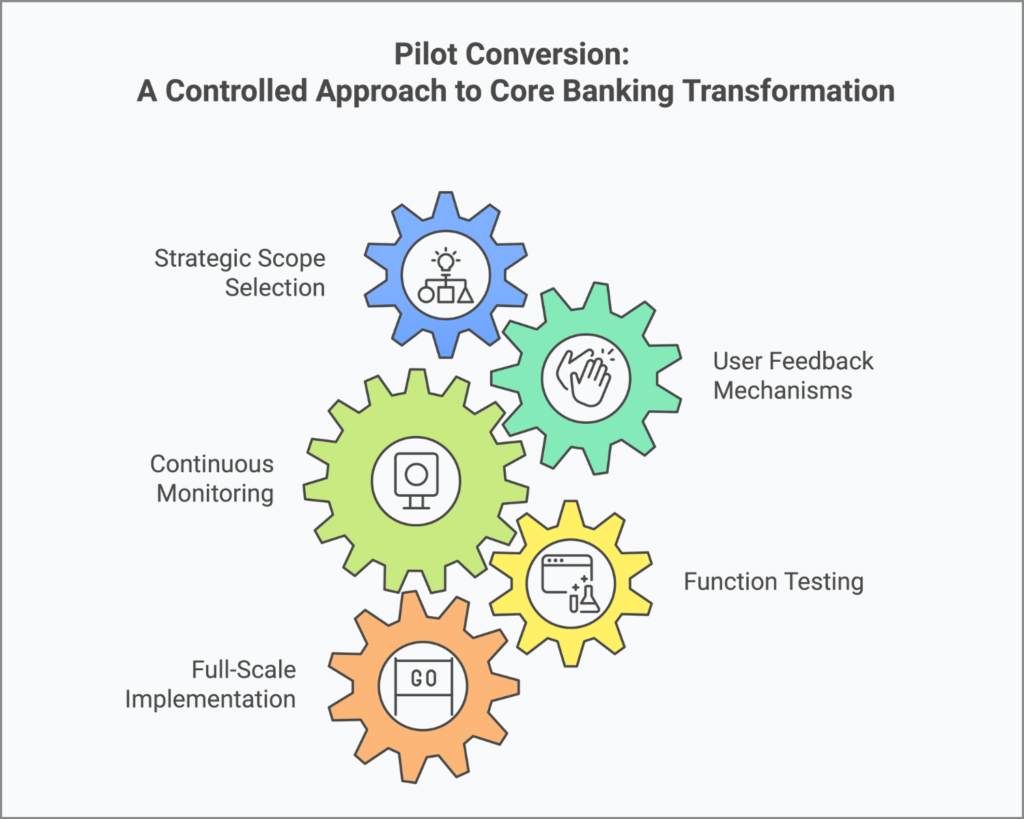

Pilot Conversion: A Controlled Approach to

Core Banking Transformation

Imagine trying a brand-new recipe for the first time. Do you make a giant batch for a dinner party, or do you test it on a smaller scale to tweak the flavors?

The same principle applies to core banking transformation. Before diving into a full-scale rollout, a Pilot Conversion lets you refine the process, identify potential hiccups, and ensure success—one step at a time.

This prudent approach is wise not only for your kitchen but also for banks undertaking core banking transformations. I recently chatted with a bank manager who explained their decision to adopt a Pilot Conversion strategy.

“We can’t afford mistakes during our core banking transformation.”

Instead of rolling out the new system to all branches at once, they started small—testing, learning, and refining in real-world conditions. The result? Fewer risks, smoother transitions, and a template for success.

Initially, they opted to introduce the new system in just one branch, allowing them to tweak and refine the setup based on real-world feedback. This cautious, controlled approach helped them avert potential disasters by addressing issues on a smaller scale before a full-scale rollout.

What is Pilot Conversion?

Pilot Conversion is….

From Isolation to Integration:

Embracing Innovation with Valued Team Updates

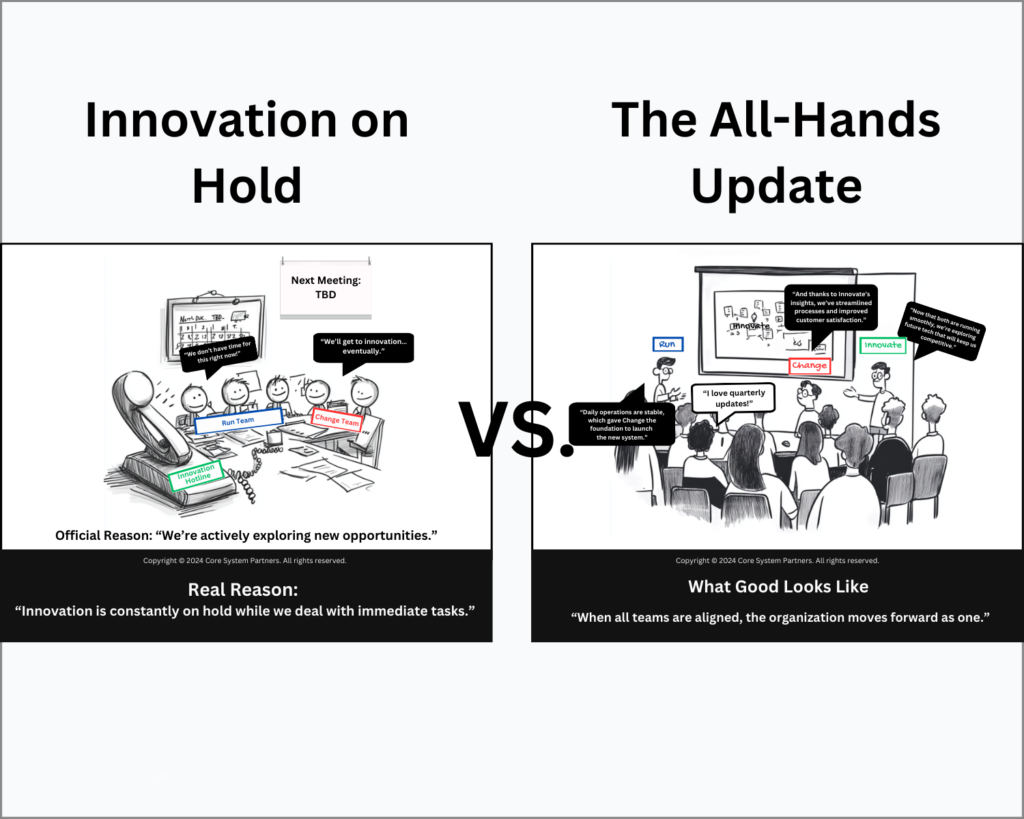

Picture this: a brilliant team with groundbreaking ideas, but instead of leading the charge, they’re tucked away in the basement—out of sight, out of mind.

Too often, innovation teams in banks face this exact scenario: equipped with resources but disconnected from the organization’s core strategy. Let’s explore how to bring them out of the shadows and into the spotlight.

In the world of core banking, where running, changing, and innovating are all essential, it’s not uncommon to see innovation left out in the cold—or, as illustrated in our cartoon “Innovators in the Basement,” literally left in the basement. Here, innovation is present but disconnected from the bank’s core activities, often given a budget but sidelined from day-to-day strategic conversations. It’s an all-too-familiar scenario: innovation teams with great ideas but no platform to share them, no resources to execute them, and little integration into the bank’s broader mission.

Contrast this with… to read more click the link:

Click the link to empower your teams and drive your bank’s success!

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.