Vol. 3

Connect, Innovate, Elevate

This issue is packed with actionable strategies on aligning teams, clearing stakeholder hurdles, and streamlining core operations.

Discover the latest headlines—from banks modernizing tech stacks and adopting AI to strategic partnerships, funding wins, and transformative acquisitions.

Whether you’re chasing innovation or simply curious about how digital advancements can revolutionize traditional banking, dive in for real-world insights, a touch of humor, and plenty of inspiration to power your transformation journey.

Mastering stakeholder readiness

Embracing innovation with valued team updates

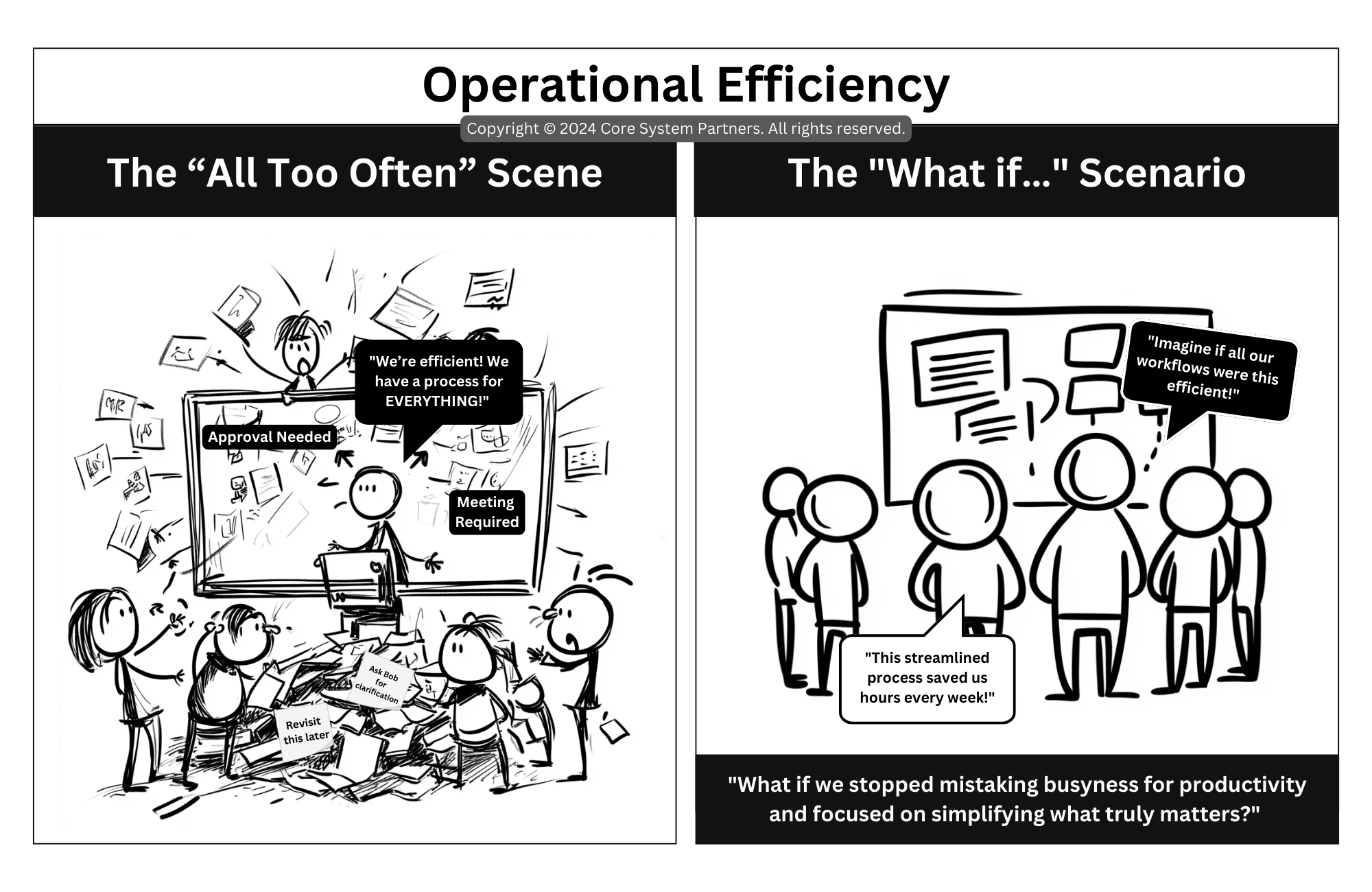

Streamlining workflows and clarifying roles turns chaos into clarity, boosting productivity, collaboration, and customer satisfaction.

Ever jumped into a big project only to discover half your team wasn’t on board? Successful transformation isn’t just about technology—it hinges on getting everyone invested and ready to embrace change. In this concise guide, you’ll learn how to foster buy-in, empower employees, and drive innovation at every level.

Ready to tackle the biggest barriers to success?

Optimizing strategy alignment

Ensuring your transformation drives business goals

Is your next big initiative set to truly move the needle—or is it just another costly project? Learn how one regional bank discovered the pitfalls of misaligned transformation and turned things around by focusing on strategic goals first.

Strategy alignment

From chaos to coordination in core banking transformations

Are endless debates and unclear roles bogging down your core banking transformation? Discover how a unified strategy, clear responsibilities, and open communication can turn confusion into collaboration. Learn the practical steps to align teams and drive real progress.

From chaos to coordination

Transforming stakeholder roles in core banking

Is your core banking transformation stuck in “The All Too Often” Scene, where unclear roles and clashing priorities stall progress? Discover how defining responsibilities, aligning goals, and fostering open communication can transform the confusion into a “What If…” scenario of collaboration and success.

From chaos to coordination

Transforming stakeholder roles in core banking

Is your core banking transformation stuck in “The All Too Often” Scene, where unclear roles and clashing priorities stall progress? Discover how defining responsibilities, aligning goals, and fostering open communication can transform the confusion into a “What If…” scenario of collaboration and success.

Core Banking News

What’s Happening in Core Banking This Week?

I once waited in a bank queue so long I practically memorized the wallpaper, so it’s a relief to see financial institutions finally shedding legacy tech.

This week’s highlights reveal how cloud-native platforms, AI breakthroughs, and strategic alliances—like Temenos joining forces with Taurus—are driving faster transactions and more innovative products.

Dive in to discover how the industry is racing toward a more efficient, customer-centric future.

Banks Warned: Modernize Core or Risk Falling Behind (TechCentral)

Legacy systems drag down innovation and customer service. Discover why agile platforms are critical for faster product launches and efficiency.

SaaScada + Arie Finance Simplify Cross-Border Payments (FF News)

Arie Finance is rolling out SaaScada’s cloud-native core to cut complexities and speed global payments. See how underserved businesses benefit from real-time integrations and streamlined operations.

Aldermore Bank Taps Temenos for Savings Upgrade (FinTech Futures)

Aldermore’s legacy core is getting a refresh for faster product releases and improved efficiency. Explore how the bank is modernizing its back-end for better customer experiences.

Lombard Odier Embeds AI with MongoDB (Finextra)

Lombard Odier partners with MongoDB to embed generative AI into its core banking stack, modernizing legacy systems and boosting scalability. This move streamlines front- and back-end operations to accelerate data-driven innovation.

Arie Finance Signs with SaaScada for Faster Transactions (Finextra)

Arie Finance is deploying SaaScada’s cloud-native core platform to streamline cross-border transactions and automate back-end processes. The upgrade aims to reduce manual complexities and deliver faster, more transparent services.

Temenos & Taurus Unite for Digital Assets (Temenos)

Temenos has integrated its core banking platform with Taurus, enabling banks to manage both digital and traditional assets on a single system. This integration streamlines processes and unlocks new asset servicing capabilities to meet evolving regulatory demands.

Zeta Lands $50M to Expand Next-Gen Core Banking (Finovate)

Zeta, known for its cloud-native core banking and credit processing solutions, has secured $50M to scale its next-gen banking stack. This capital will help banks replace legacy systems and launch new products faster.

FIS Targets 9-11% Growth with Core Banking Boost (MSN)

FIS projects a 9-11% EPS increase driven by new core banking wins and expanding digital services. This bullish outlook reflects the industry’s push to modernize operations and boost digital capabilities.

Al Rayan Bank Upgrades Core with Finastra (IBS Intelligence)

Al Rayan Bank is partnering with Finastra to modernize its core banking infrastructure, streamlining back-end processes and enhancing digital services. This upgrade aims to boost customer experience and keep the bank competitive in today’s fast-evolving financial landscape.

Zeta Raises $50M at $2B Valuation (FinTech Futures)

Zeta secures $50M in new funding, lifting its valuation to $2B and fueling the development of its cloud-native core banking platform. The capital boost will help banks replace legacy systems and launch new products faster in the digital era.

nCino Buys Sandbox Banking for $52.5M (FinTech Futures)

nCino acquires Sandbox Banking to enhance its integration platform as a service (iPaaS), simplifying connections between disparate core banking systems. This strategic move streamlines deployments and automates back-end processes, enabling faster rollout of digital services.

Netcompany Acquires SDC, Boosting Nordic Core Banking (Finextra)

Netcompany’s acquisition of SDC brings together expertise to modernize core banking across the Nordics, streamlining back-end systems with advanced technologies. This strategic move is set to accelerate digital transformation for member banks.

McKinsey’s Omnistack: Incremental Core Modernization (McKinsey)

McKinsey introduces the Omnistack model, which layers microservices onto existing systems to modernize core banking incrementally with minimal disruption. This approach drives faster innovation and reduces risk compared to full overhauls.

Ready for More?

Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey.

Click here to read the full articles!

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.