Vol. 4

Connect, Innovate, Elevate

I once tried paying a bill on my bank’s “modern” platform—only to find it slower than an old dial-up connection. If you’ve been there, you’ll appreciate how this newsletter tackles the big pain points head-on, from adopting agile strategies to ensuring seamless tech compatibility and clearing stakeholder hurdles.

This roundup spotlights real-world transformations in the Philippines, Saudi Arabia, and beyond, showing how financial institutions are embracing AI, automation, and more efficient core systems.

Dive in for hands-on tips, subtle humor, and a realistic but optimistic take on staying competitive in the ever-evolving world of core banking.

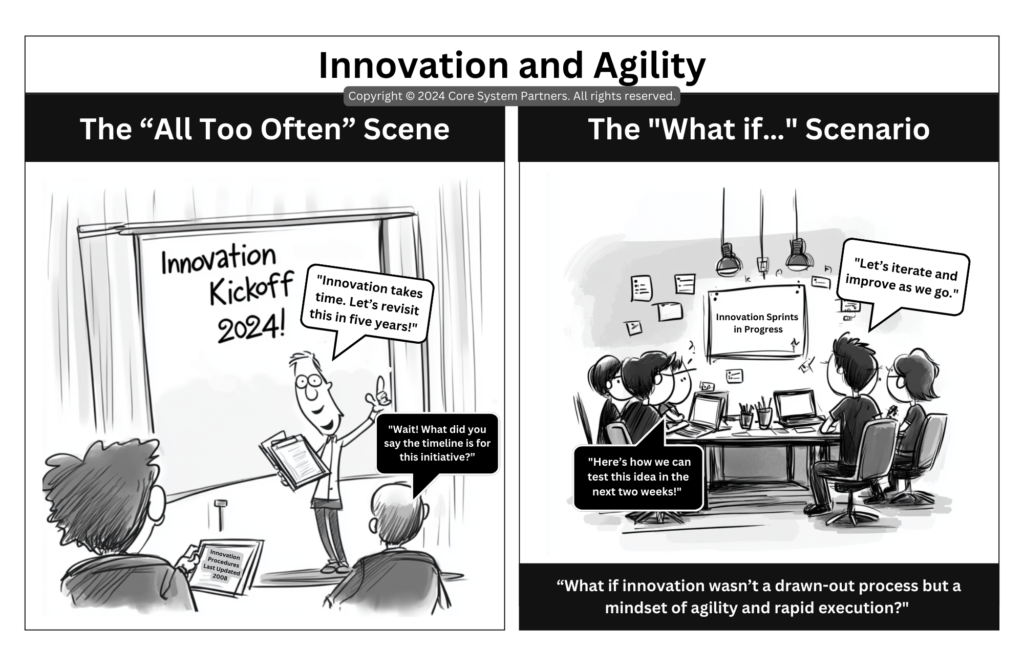

From delays to agility

Redefining innovation in core banking

Is innovation still “in the pipeline” at your bank? Discover how switching to an agile, sprint-based approach can transform years-long delays into rapid iterations. Learn why embracing shorter timelines, clear roles, and a culture of experimentation can help you outpace the competition.

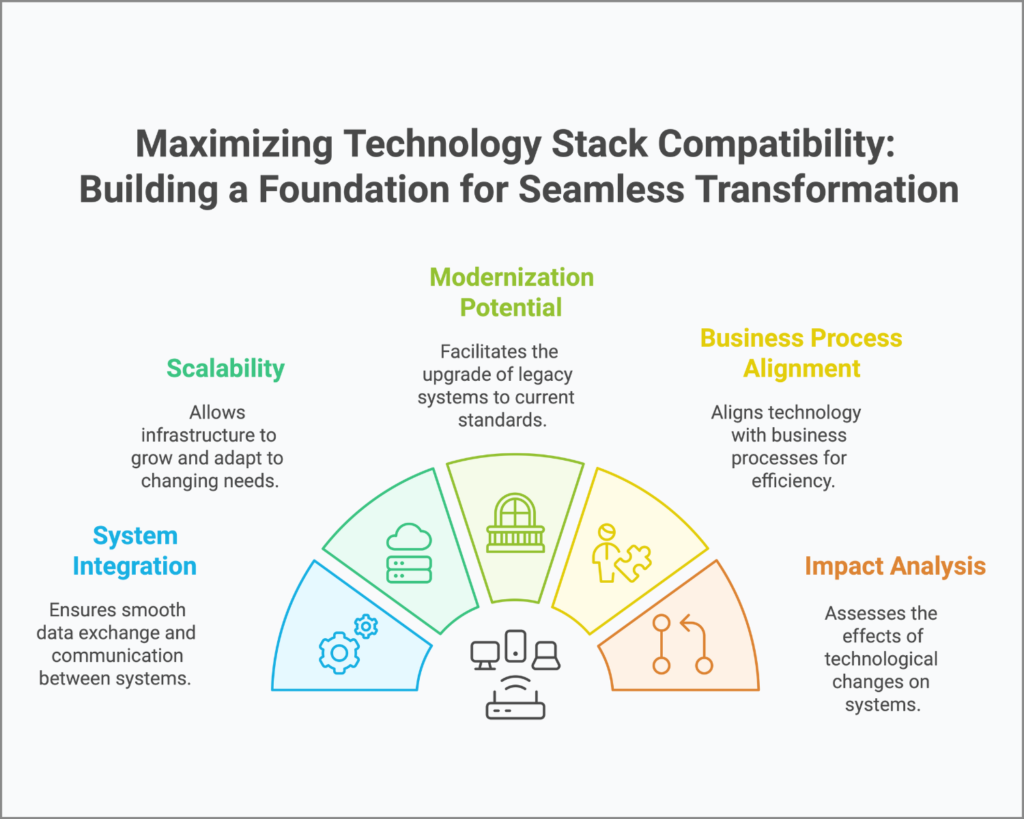

Maximizing technology stack compatibility

Building a foundation for seamless transformation

Is your bank’s new core system feeling like a square peg in a round hole? Learn why technology stack compatibility is the key to a smooth transformation. Get best practices, real-world stories, and critical steps for building a scalable, future-ready infrastructure.

Click here to read the full article

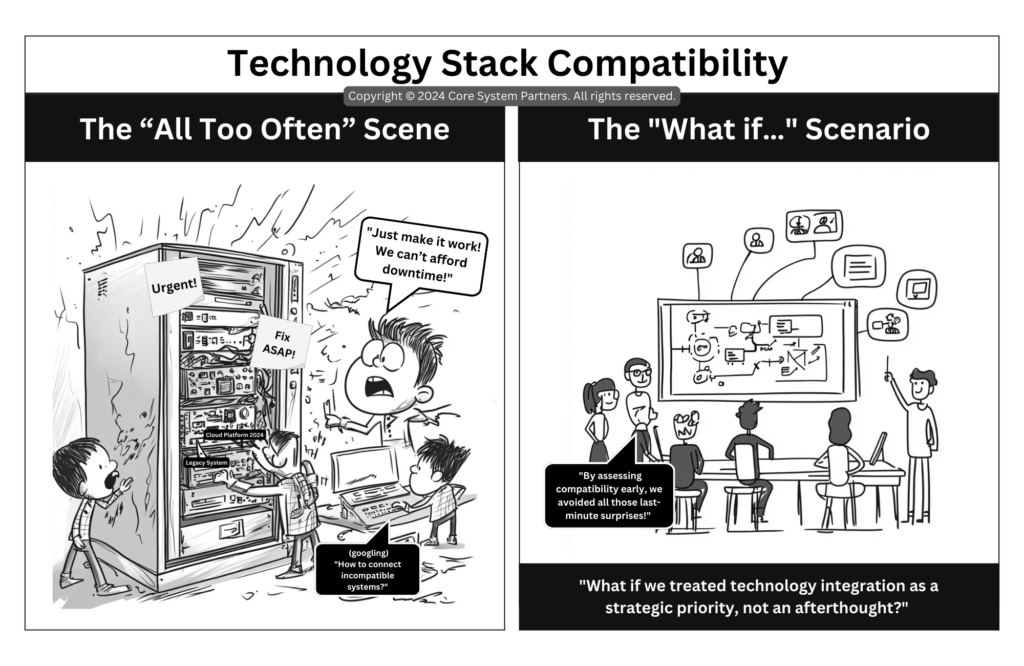

From firefighting to strategic integration

Prioritizing technology stack compatibility in core banking

Is your core banking transformation hitting constant roadblocks due to tech incompatibility? Learn how to build a flexible, future-ready foundation that supports smooth integrations, scalable growth, and faster innovation. Click through for the essential steps and real-world insights on prioritizing technology stack compatibility.

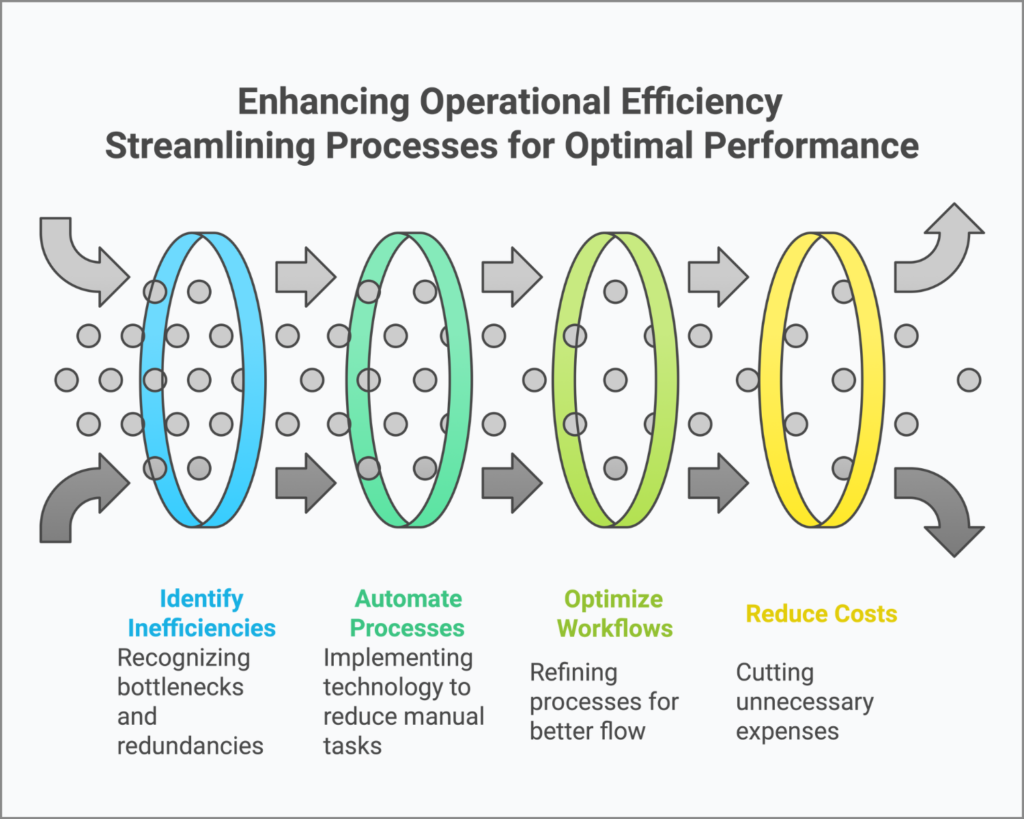

Enhancing operational efficiency

Streamlining processes for optimal performance

At a crossroads in your core banking transformation? Dive into the pros and cons of Big Bang, Phased, Parallel, and Incremental approaches to find the strategy that fits your bank’s unique needs.

Core Banking News

What’s Happening in Core Banking This Week?

Welcome to this week’s roundup on core banking transformation! Banks are stepping up their game as they ditch outdated systems for real-time data and seamless digital integration.

CTBC Bank Philippines is joining forces with Hitachi Asia to overhaul its digital corporate banking platform, ensuring smoother workflows behind the scenes. Meanwhile, Access Bank is revamping its back-end systems to speed up processing and roll out new products faster. And in Saudi Arabia, stc bank and D360 are leading a digital leap with innovative banking models that promise to modernize core operations for a tech-savvy customer base.

Ready to see how these bold moves are reshaping the future of banking? Dive into the full stories for all the details!

CTBC Bank Philippines x Hitachi Asia: Corporate Banking Overhaul (inTech Futures)

CTBC Bank Philippines is upgrading its digital corporate banking platform in partnership with Hitachi Asia, integrating real-time data and streamlining workflows. While labeled “corporate,” these improvements likely enhance the bank’s core infrastructure behind the scenes.

Access Bank’s Core System Upgrade (TechCabal)

Access Bank is set to overhaul its back-end systems for faster processing, seamless digital integration, and new product rollouts. By focusing on its core platform, the bank aims to stay nimble in today’s rapidly changing market.

Saudi Arabia Digital Banking Leap with stc bank and D360 (Retail Banker International)

Saudi Arabia’s banking sector is taking a giant leap forward as stc bank and D360 launch innovative digital banking models. These initiatives hint at modernized core systems built for end-to-end online operations to serve a tech-savvy customer base.

Lombard Odier selects MongoDB to modernise core banking tech with Gen AI

Lombard Odier is partnering with MongoDB to integrate generative AI and real-time analytics into its core systems. This cloud-native upgrade promises faster product launches and more personalized services.

Fusion Bank launches next-gen core banking system with Tencent Cloud

Fusion Bank teams up with Tencent Cloud to roll out a next-gen core banking solution that streamlines back-end operations and supports real-time data processing. This upgrade sets the stage for a fully digitized, agile future.

nCino acquires Sandbox Banking for $52.5M to simplify financial integrations

nCino has acquired Sandbox Banking to simplify integration between legacy systems and its cloud banking platform. This $52.5M move aims to reduce development time and complexity, accelerating the adoption of its core solutions.

Ready for More?

Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey.

Click here to read the full articles!

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.