Vol. 6

Connect, Innovate, Elevate

Let’s be honest—digital transformation gets thrown around so much, it’s starting to sound like background noise. But in this issue, we cut through the buzz and get into the real stories of banks making it happen.

From AI-powered core rollouts to compliance strategies that actually help your bottom line, this edition is packed with practical insights for leaders who are done tinkering at the edges and ready to drive serious change. We dive into how banks are trading patchwork fixes for scalable platforms, why incremental modernization is edging out risky rip-and-replace moves, and how some smart partnerships (hello, JPMorgan and Thought Machine) are reshaping the game.

We’re also zooming in on customer experience—the kind that doesn’t just reduce complaints, but builds loyalty. And if you’ve ever had a project stall out mid-flight, don’t worry—we’ve got a whole section on strengthening delivery so your next transformation actually lands.

So grab a coffee, dig in, and let’s explore how real progress in core banking is taking shape—one thoughtful, strategic move at a time.

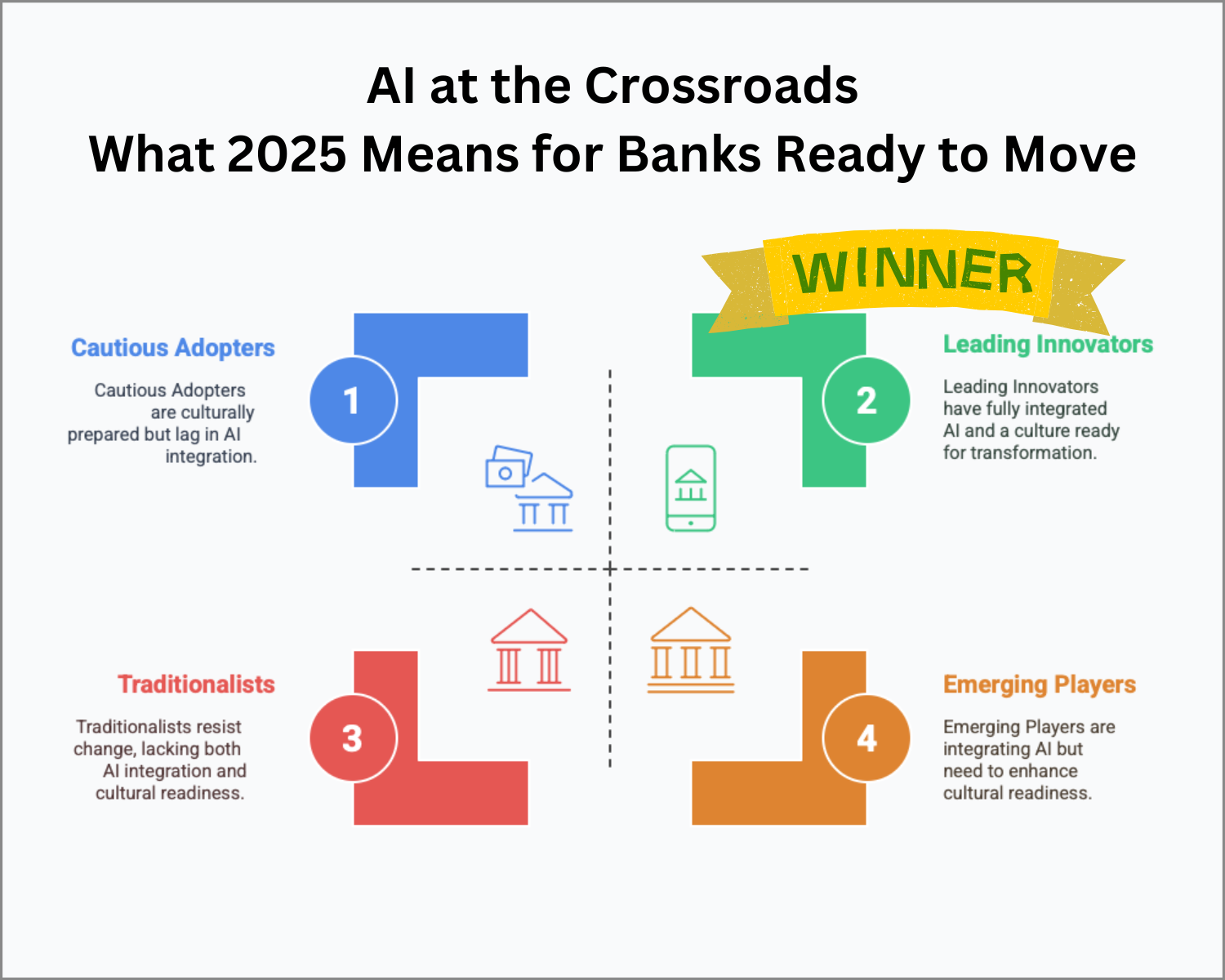

AI at the Crossroads

What 2025 Means for Banks Ready to Move

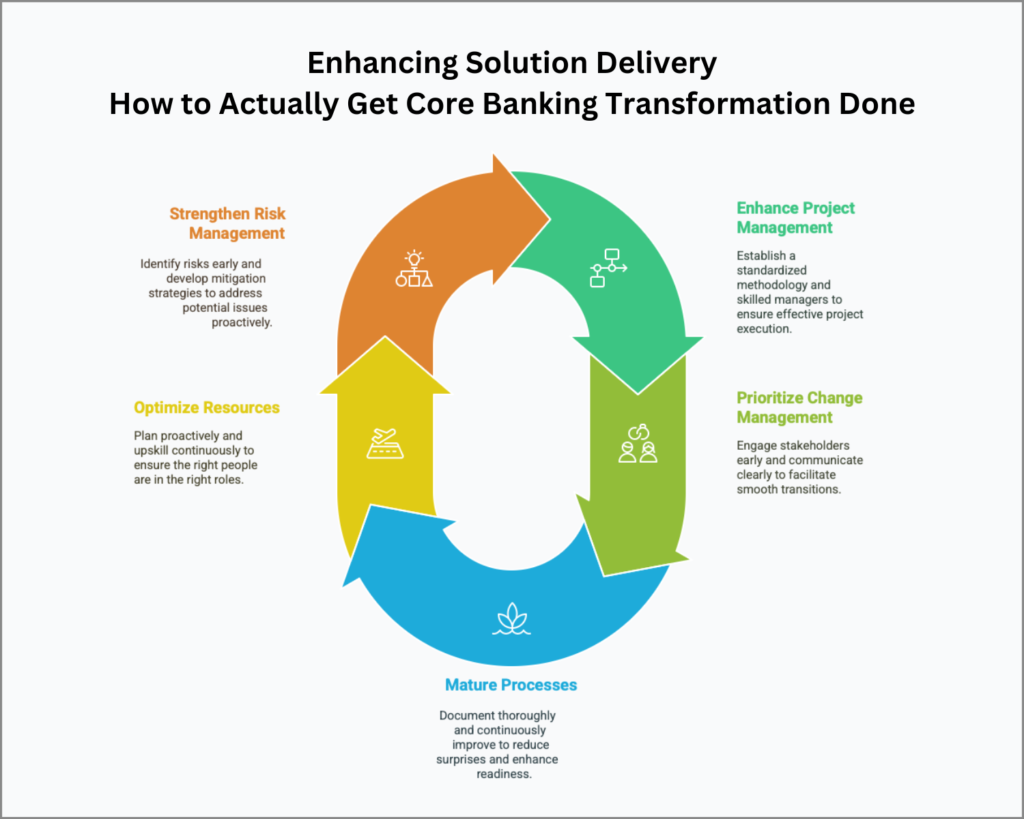

Is your bank’s transformation project stuck in a cycle of missed deadlines and frustrated stakeholders? Discover how robust solution delivery capabilities – from structured project management to proactive risk mitigation – can keep your initiatives on time and on budget. Ready to turn ambitious goals into concrete successes?

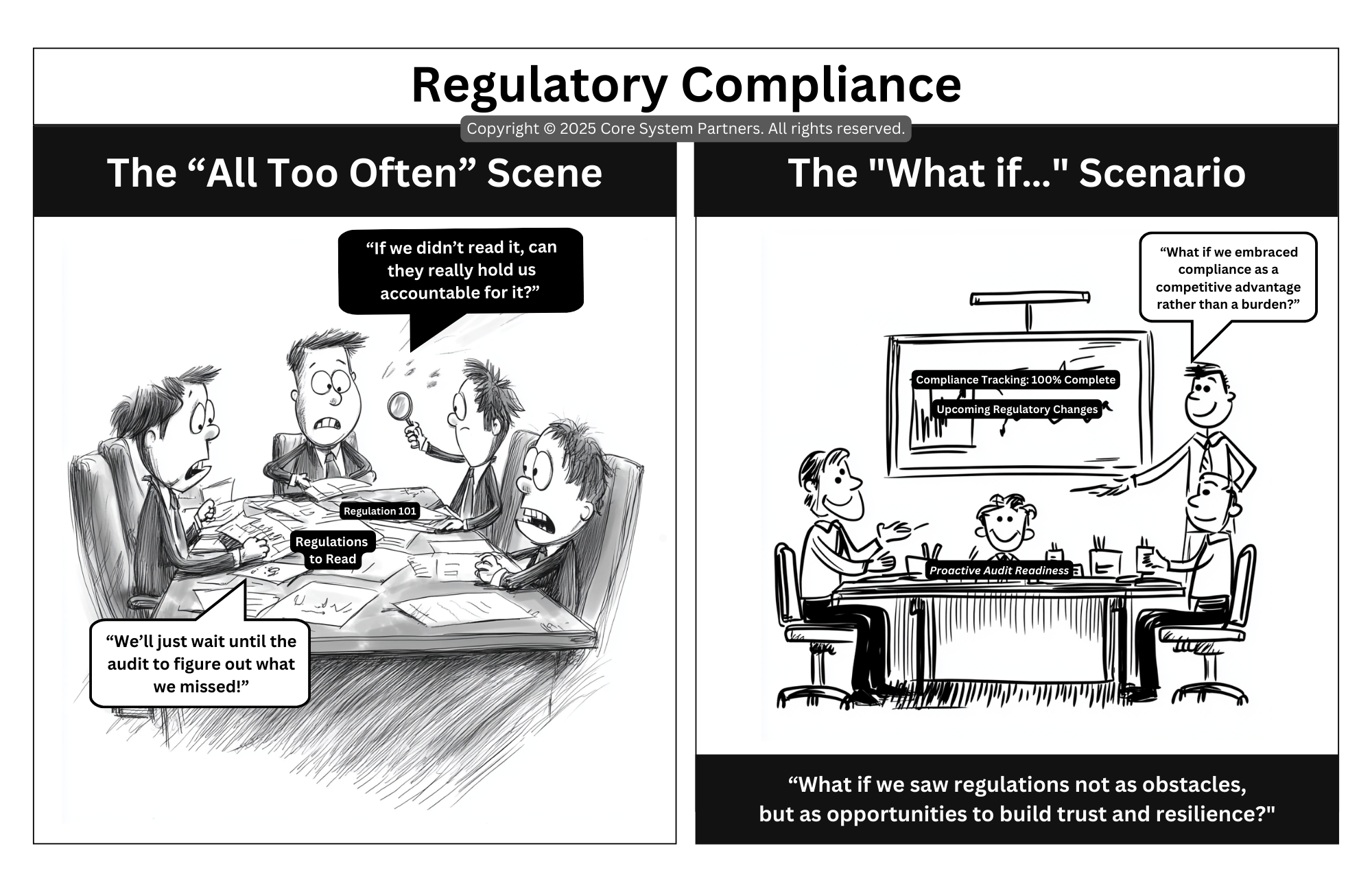

From compliance chaos to competetive advantage

Transforming regulatory readiness

Is your team drowning in endless regulations? Discover how a proactive, real-time approach to compliance can turn stressful audits into strategic wins. Learn the key steps to streamline accountability, track progress seamlessly, and leverage compliance as a true differentiator.

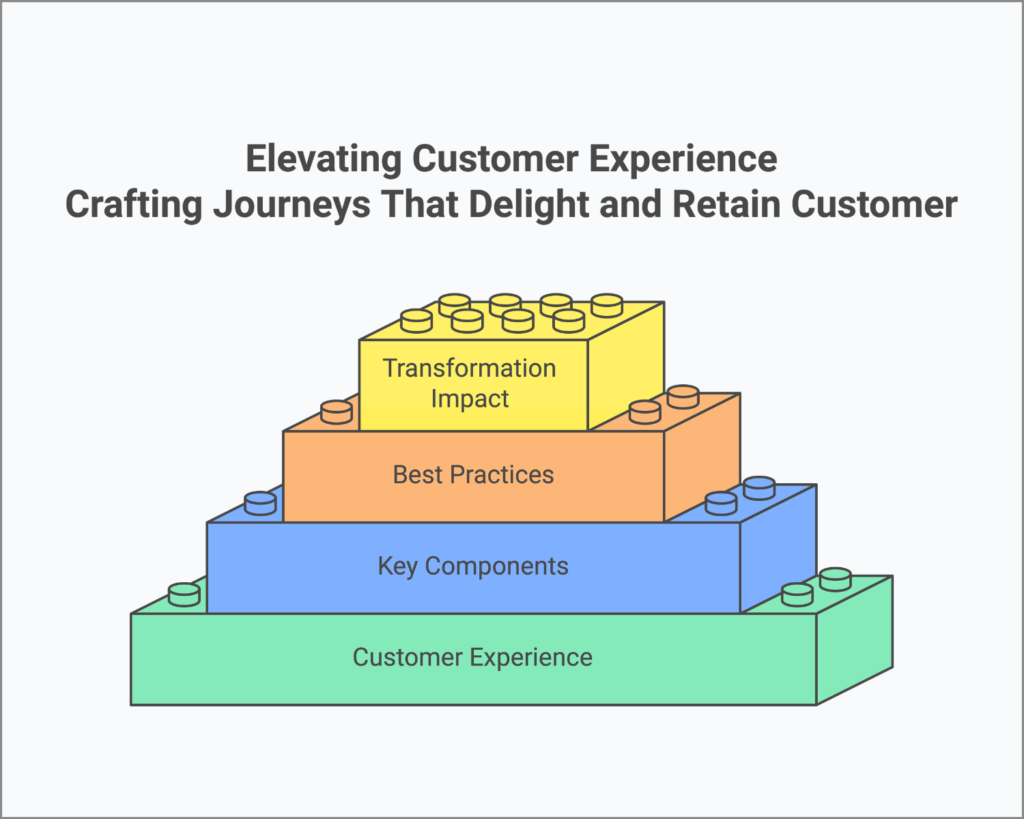

Elevating customer experience

How to craft journeys that keep customers coming back

Building customer experience: Key components, best practices, and transformation impact for customer-centric banking.

Is your bank merely offering products, or creating memorable experiences? Discover how to build customer journeys that don’t just satisfy but truly delight—boosting loyalty, revenue, and your brand’s reputation. Click through for insights on transforming your core operations around exceptional CX.

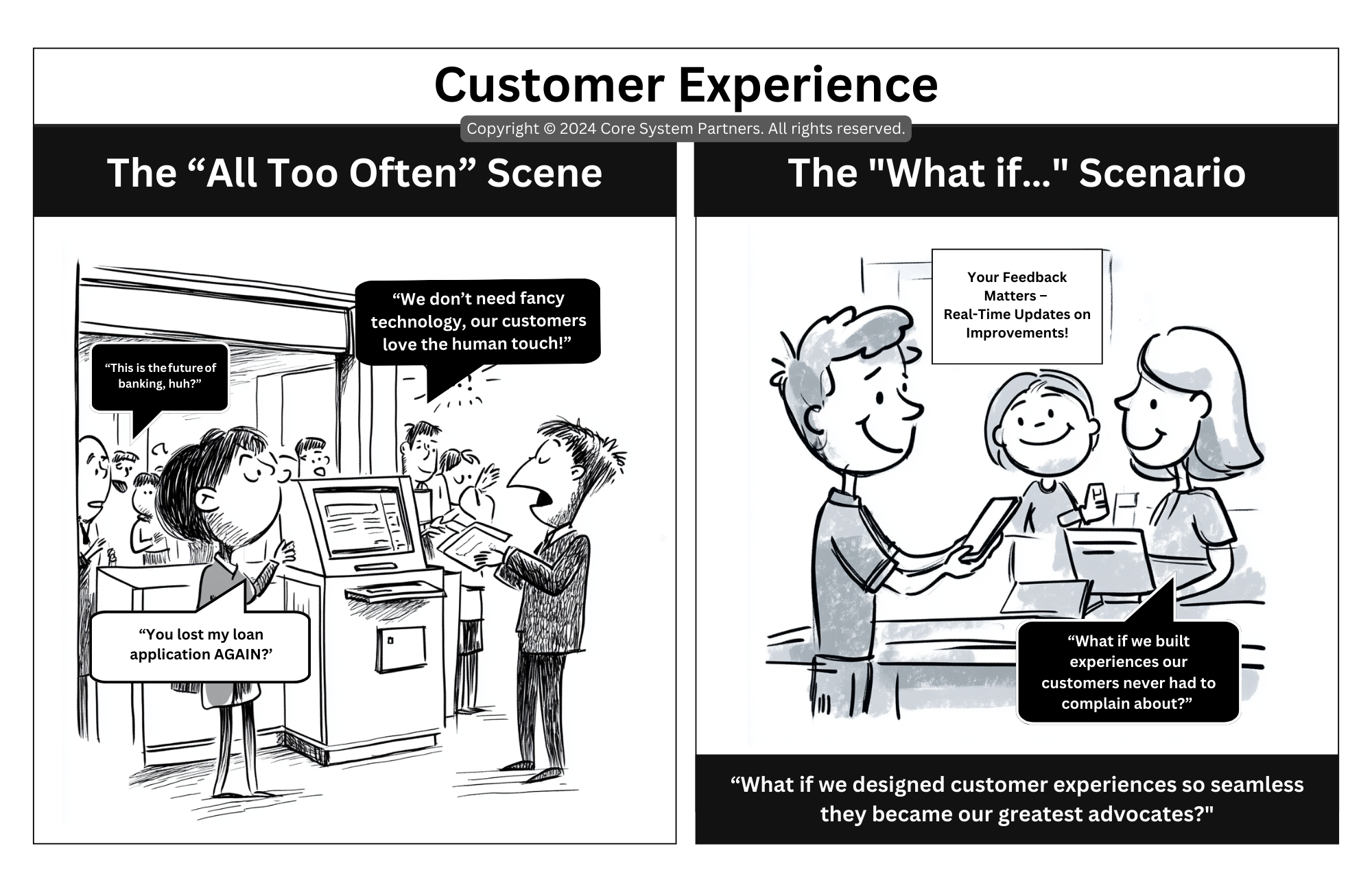

From frustration to advocacy

Transforming the customer experience in core banking

Still hearing “lost application” complaints? Learn how modern tech, seamless processes, and empowered teams can turn your customers from frustrated to brand champions. Ready to see how a coordinated approach can elevate your core banking experience?

Enhancing solution delivery

How to actually get core banking transformations done

Struggling to execute big ideas? Learn how strengthening solution delivery capabilities – from project management frameworks to effective risk mitigation – can transform core banking initiatives into real, measurable success. Ready to ensure your projects hit deadlines, stay on budget, and earn stakeholder trust?

Core Banking News

What’s Happening in Core Banking This Week?

I once tried depositing a check with my phone camera, only to be greeted by a cryptic error message that set me back to the days of dial-up. If you’ve ever faced a similarly clunky process, you’ll be glad to hear how this week’s core banking updates tackle those very hiccups—everything from Transparent Data Encryption (TDE) for airtight security to cloud-based transformations and phased migrations that preserve day-to-day operations.

In these stories, you’ll see banks and fintechs adopting microservices, sealing M&A deals (like Alkami’s $400M swoop of Mantl), and steadily migrating away from legacy bottlenecks. Whether it’s Fiserv DNA boosting a credit union’s agility or Finovifi acquiring Modern Banking Systems to streamline integrations, each piece offers a realistic but promising glimpse at how institutions can stay secure, efficient, and ready for tomorrow.

Dive in and discover the very real possibilities for transforming even the most stubborn of back-end systems—without losing a wink of sleep (or an entire morning in a failed deposit attempt).

GTBank Goes Live with Infosys Finacle

GTBank completes a major overhaul by deploying Finacle as its new core system. Expect faster transactions, enhanced digital channels, and greater efficiency bank-wide.

Core Banking: The Modernization Playbook

A FinTech Futures overview showcases how banks can transition from outdated cores to agile, cloud-native platforms. Partial migrations, microservices, and scalability are at the heart of this trend.

Thought Machine Bags JPMorgan Chase Deal

Chase bets on Thought Machine’s cloud-native solution for enhanced customization, real-time processing, and rapid rollouts.

Intellect Unveils Emach AI

A new open finance core system integrating AI to cut legacy ties and speed deployments with open APIs.

Bendigo + Adelaide Bank + MongoDB

Bendigo and Adelaide Bank partners MongoDB for an AI-driven core banking update, aiming for faster product launches and reduced reliance on legacy systems.

Corelation’s Keystone Adds New Clients

A Forbes Council piece on gradually migrating legacy cores via cloud-native architectures. Adopting agile methods avoids ripping out entire systems while boosting scalability and reducing overhead.

MBT Bank Outsources Core to Jack Henry

A Rs 1.7 billion contract could revamp Bank of Azad Jammu and Kashmir’s aging infrastructure. Despite questions around transparency, this overhaul aims to modernize the bank’s back-end operations.

Republic Bank Adopts DNA from Fiserv

Republic Bank accelerates its digital transformation by upgrading to DNA, streamlining processes and enhancing the customer experience.

Ready for More?

Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey.

Click here to read the full articles!

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.