Vol. 7

New Book Drop

The Strategic Flywheel

by Rick Mavrovich

| We’re excited to announce the launch of a must-read for every leader serious about transformation: The Strategic Flywheel – Run, Change, Innovate: A Playbook for Modern Bank Transformation. |

| In this bold new release, author Rick Mavrovich—seasoned advisor and transformation strategist—dives deep into the heart of what separates banks that survive from those that scale. Based on 30+ years of front-line experience, this book isn’t about silver bullets or vague innovation platitudes. It’s about systems that work. |

| Inside, you’ll learn: |

- Why expecting the same team to run, change, and innovate the bank is a recipe for burnout—and how to fix it.

- How to shift organizational mindsets to balance efficiency with adaptability and bold innovation.

- The Strategic Flywheel model: an integrated system that harmonizes priorities, people, and capital.

- Real-world case studies and tactics for clarifying strategy, restructuring teams, and aligning budgets with transformation goals.

- How to turn fragmented efforts into sustainable momentum—across compliance, operations, and innovation.

| If your bank is juggling stability, transformation, and digital disruption, this book delivers a clear, practical path forward. Think of it as a blueprint for turning transformation from a one-off project into a continuous, high-impact cycle. |

| Are you ready to stop spinning your wheels—and start building your flywheel? |

Connect, Innovate, Elevate

Let’s be honest—digital transformation gets thrown around so much, it’s starting to sound like background noise. But in this issue, we cut through the buzz and get into the real stories of banks making it happen.

From AI-powered core rollouts to compliance strategies that actually help your bottom line, this edition is packed with practical insights for leaders who are done tinkering at the edges and ready to drive serious change. We dive into how banks are trading patchwork fixes for scalable platforms, why incremental modernization is edging out risky rip-and-replace moves, and how some smart partnerships (hello, JPMorgan and Thought Machine) are reshaping the game.

We’re also zooming in on customer experience—the kind that doesn’t just reduce complaints, but builds loyalty. And if you’ve ever had a project stall out mid-flight, don’t worry—we’ve got a whole section on strengthening delivery so your next transformation actually lands.

So grab a coffee, dig in, and let’s explore how real progress in core banking is taking shape—one thoughtful, strategic move at a time.

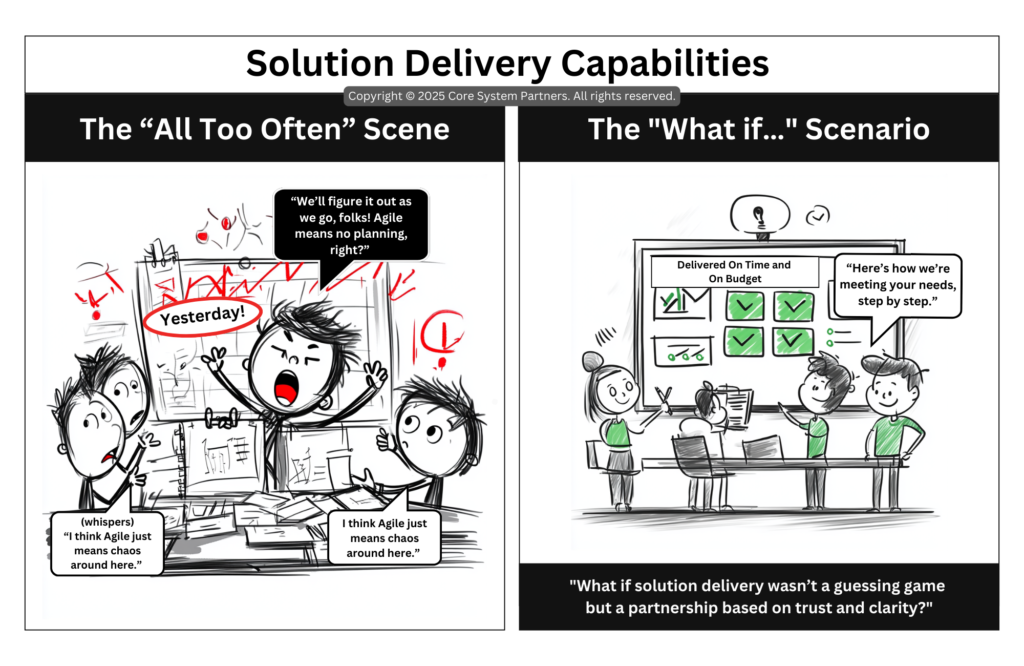

From chaos to clarity

Transformation solution delivery in core banking

Is your core banking project a guessing game of missed deadlines and frustrated teams? Discover how structured roles, agile planning, and transparent communication can replace confusion with seamless, trust-based delivery. Ready to transform solution delivery from reactive firefighting into a reliable, step-by-step partnership?

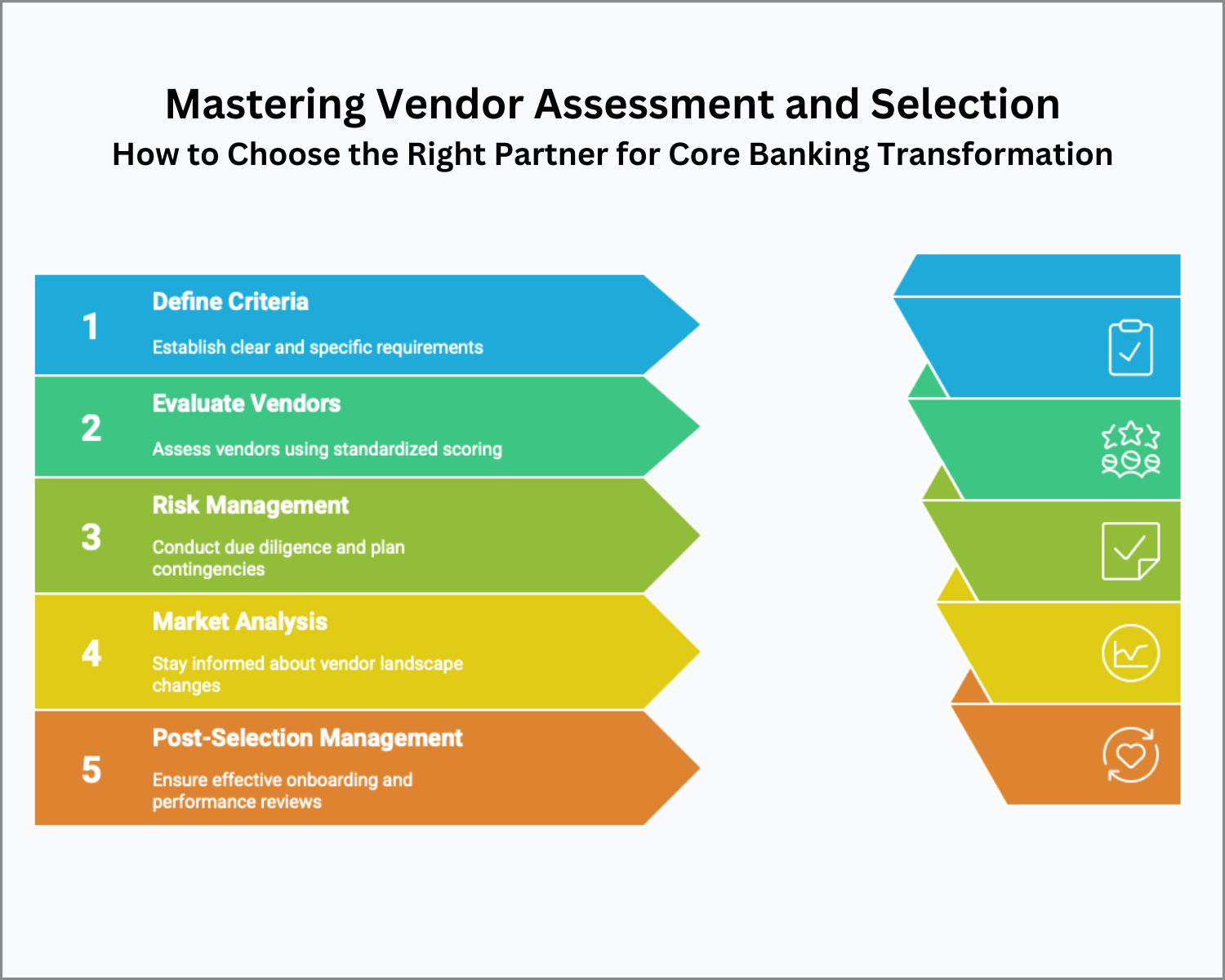

Mastering vendor assessment and selection

How to choose the right partner for core banking transformation

Mastering vendor selection for core banking transformation: Ensure smooth delivery, mitigate risks, and build long-term partnerships with the right approach.

Feeling burned by a flashy vendor promise that never delivered? Learn how a disciplined, future-focused approach to vendor assessment and selection can transform risky guesswork into strategic advantage. Discover the must-have steps to avoid hidden pitfalls, build real partnerships, and power your next banking overhaul.

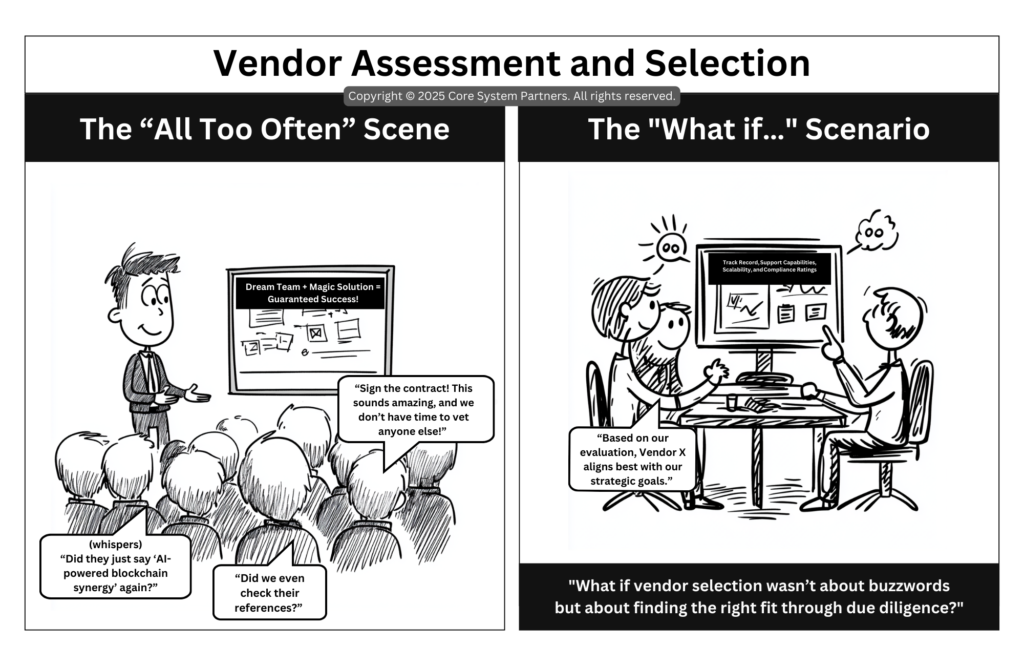

From buzzwords to business value

Rethinking vendor assessment in core banking

Vendor selection in core banking transformation: Move beyond buzzwords and choose strategic partners through structured evaluation, collaboration, and due diligence.

Tired of flashy vendor pitches that don’t deliver? Learn how a data-driven, cross-functional approach to vendor selection can transform your core banking projects from risky gambles into strategic wins.

Core Banking News

What’s Happening in Core Banking This Week?

I once spent half my lunch break waiting for an online banking page to load, only to realize I could’ve driven to the nearest branch faster. If you’ve ever been there, you’ll appreciate how this week’s core banking updates tackle clunky back-end systems head-on—whether it’s Sparebanken Norge teaming with Tietoevry for a cloud-ready framework or Redwood Bank adopting Finova’s agile platform to accelerate new product rollouts.

From Infosys helping Allied Irish Banks ditch legacy tech to Avaloq’s entry into Dubai for a wealth-tech revolution—and let’s not forget how Salt Bank soared to 500,000 customers with Starling Engine—these stories show just how pivotal modern, scalable core architecture can be in shaping the next wave of digital banking. Dive in for a look at how these forward-thinking institutions are streamlining operations, boosting efficiency, and proving that the shortest lunch break can still squeeze in a hassle-free banking experience.

Sparebanken Norge Collaborates with Tietoevry

Sparebanken Norge is upgrading its core banking framework by partnering with Tietoevry to deploy scalable, cloud-ready technology. This move streamlines back-end operations, cuts reliance on outdated systems, and sets the stage for future digital initiatives.

Finova Delivers Core Banking Servicing Upgrade for Redwood Bank

Redwood Bank is modernizing its core by adopting Finova’s agile, cloud-based platform, designed to streamline back-end workflows and accelerate new product rollouts. The upgrade enhances digital service delivery and replaces legacy technology for a more competitive infrastructure.

Infosys and AIB Extend Strategic Collaboration for Digital Transformation

Infosys and Allied Irish Banks are expanding their partnership to further modernize AIB’s core technology platforms. By transitioning from legacy systems to agile, cloud-ready frameworks, the collaboration aims to boost back-end efficiency and speed up digital transformation efforts.

Avaloq Enters Dubai to Hasten the Wealth-Tech Revolution in the GCC

Modernizing its core, Great Southern Bank picks Fiserv to streamline back-end operations and boost scalability for future rollouts.Avaloq is expanding into Dubai to deliver advanced wealth management solutions integrated with its core banking framework. This move is set to drive regional adoption of cloud-ready, modular core platforms that modernize back-end infrastructures.

Salt Bank Reaches 500,000 Customers with Starling Engine

Salt Bank credits its rapid growth to Starling Engine’s modern, cloud-native core architecture, which streamlines back-end processes and accelerates product rollouts. This agile upgrade enhances account setup efficiencies, showcasing the impact of advanced core systems in a competitive market.

Ready for More?

Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey.

Click here to read the full articles!

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.