Vol. 11

What your vendor won’t tell you.

What your team needs to hear.

One issue a week.

The only newsletter designed for banking execs who actually have to deliver

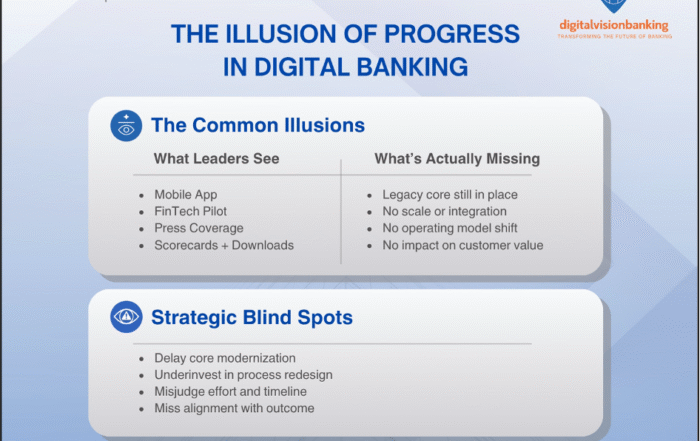

| If your roadmap looks good on paper but your teams are buried in outages, budget battles, or AI buzzword bingo—you’re not alone. This week’s Core Insider dives into the hidden costs of downtime, the illusion of strategy without investment, and how to prep your core for the next wave of innovation. |

| Inside, we’re also tackling: |

- Downtime risks: Why even a “short” outage can cost more than you think

- Innovation budgeting: How underfunding today quietly sabotages tomorrow

- Core modernization updates from Fiserv, Ikano, Isbank, KAF, and more

- AI overload: Turning hype into impact, not shelfware

- Smart cost control without cutting corners

- Career openings if you’re ready to make transformation real

| Grab a coffee—this issue is a reality check with a roadmap attached. |

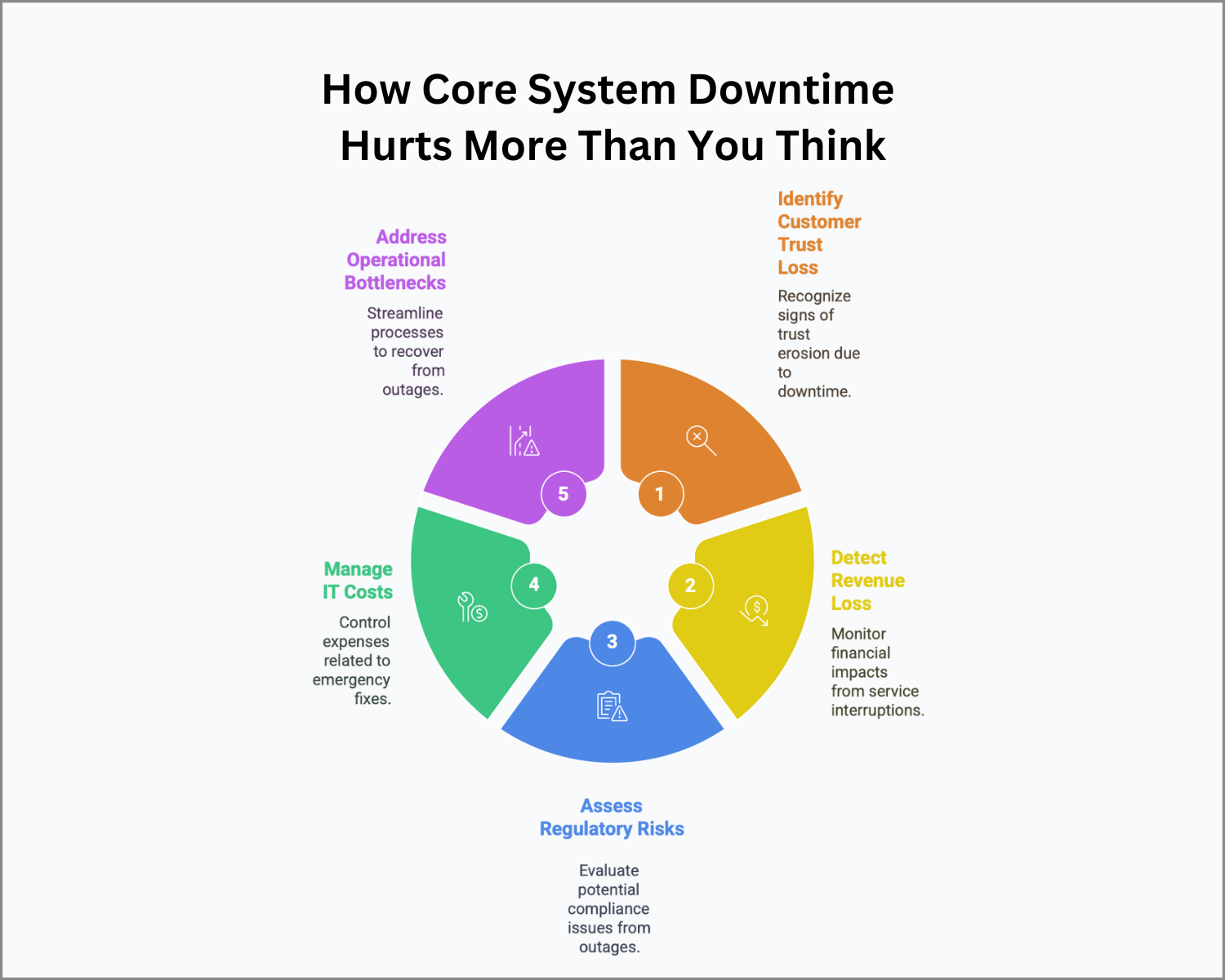

How core system downtime hurts

more than you think

| A single outage can drain revenue, erode trust, spark regulatory heat, and overload your teams—often without setting off alarms. Learn the hidden costs and how the OptimizeCore® Scorecard pinpoints fixes before they become headlines. Curious where your weak spots are? |

Core Banking News

What’s Happening in Core Banking This Week?

Legacy systems are falling like dominoes.

From Isbank UK’s switch to Softtech’s Plateau platform to Ikano Bank’s move onto TCS BaNCS, the race to modernize is picking up speed—and scale. Fiserv is slashing its U.S. core stack by two-thirds, while KAF Digital Bank is already live with Temenos SaaS. Even state-backed co-ops in India are jumping aboard cloud-native platforms with heavyweight partners like TCS and Wipro.

Miss these moves and you’ll miss the signal.

Fiserv Highlights Core Banking Modernization at Baird Conference

At Baird’s Global Conference, CEO Mike Lyons announced plans to cut U.S. core systems from 16 to 5, leveraging the cloud-native Finxact API core, while rolling out an embedded finance platform and the XD digital suite to supercharge its core banking capabilities.

Isbank UK Goes Live with Plateau Core Banking System

Isbank UK has implemented the Plateau core banking platform from Softtech, creating a resilient, scalable foundation for future growth and digital services. This migration modernizes back-end operations and prepares the bank for rapid innovation.

KAF Digital Bank Launches on Temenos SaaS Platform

Malaysia’s KAF Digital Bank is now live on Temenos’ SaaS suite—covering core banking, payments, analytics, and data management—to deliver Shariah-compliant digital services. This deployment streamlines operations and supports the bank’s digital growth strategy.

Fujitsu Unveils Cloud-Native Core Banking Solution

Fujitsu has launched a new cloud-native core banking platform designed to give financial institutions greater flexibility and scalability. This solution tackles legacy limitations, enabling faster deployments and seamless digital transformations.

Ikano Bank Goes Live with TCS BaNCS Core for Loans and Deposits in Sweden

Ikano Bank has rolled out TCS BaNCS as its new core platform, kicking off a wider pan-European transformation to consolidate operations onto a single, scalable system. This migration modernizes back-end processes and paves the way for faster, more unified digital services.

Uttar Pradesh Government to Strengthen Cooperative Banks with Advanced Cybersecurity Overhaul

The Uttar Pradesh government will integrate 50 district cooperative banks onto a cloud-based Core Banking System platform, partnering with TCS and Wipro to boost cybersecurity and operational efficiency. This overhaul aims to strengthen back-end infrastructure and support future digital initiatives across the state.

Ready for More?

Dive into the highlights to see how leaders in the banking space are tackling innovation, efficiency, and scalability head-on. Let these stories inspire your own transformation journey.

The innovation budget paradox

When strategy is free but falling

behind isn’t

Want breakthrough results without footing the bill? Find out why under-funded “strategies” stall growth—and how a dedicated innovation budget, clear ownership, and fast pilots turn ambition into ROI. Ready to fund the future instead of firefighting the past?

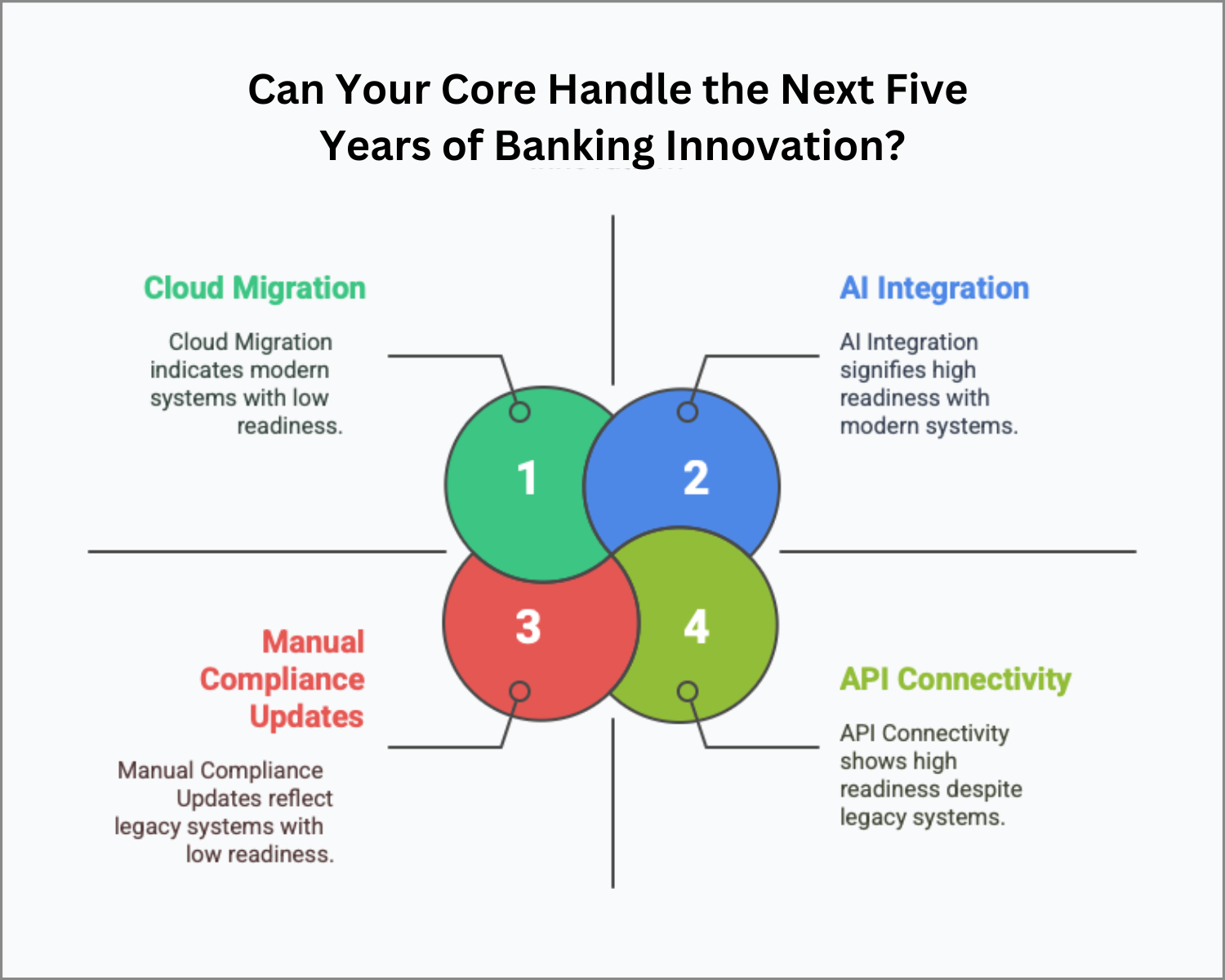

Can your core handle the next five years of banking innovation?

AI everywhere, cloud now, open APIs, blockchain rails, and ever-tougher regs are reshaping banking. Find out if your core can pivot—or if it’s quietly holding you back. Explore the five trends, gauge your readiness, and see how the OptimizeCore® Scorecard pinpoints next steps.

AI Overload

Why tools alone won’t transform your bank

Sprinkling “AI-powered” tools into your roadmap won’t drive transformation—solving real problems will. Learn how to align AI with clear business goals, pilot for measurable impact, and avoid pricey tech shelfware. Ready to turn hype into results?

Sprinkling “AI-powered” tools into your roadmap won’t drive transformation—solving real problems will. Learn how to align AI with clear business goals, pilot for measurable impact, and avoid pricey tech shelfware. Ready to turn hype into results?

Core Banking Costs

Smart Strategies to Cut Expenses

(Without Cutting Corners)

Hidden costs like messy data migration, shaky integrations, and neglected change management can turn core upgrades into financial sinkholes. Discover the five budget-busting traps—and how a quick OptimizeCore® Scorecard keeps your transformation on time and on target.

Stay Connected with Core Insider

Thank you for being a part of our Core Insider community! Stay ahead in core banking transformation with our expert insights, actionable strategies, and curated news.

Explore More:

- Visit Our Blog for in-depth articles and thought leadership.

- Follow Us on LinkedIn for daily tips and industry updates.

- Contact Us for collaboration inquiries or to learn more about our services.

Join the Conversation:

Have insights to share or questions about today’s newsletter? Reply to this email or join the discussion on our LinkedInPage.

Looking for Talent or Opportunities?

Check out our Careers Page for exciting opportunities in core banking transformation.

Spread the Word:

Enjoyed this issue of Core Insider? Forward it to a colleague or friend who would benefit from these insights.

Stay Inspired. Stay Informed. Stay Connected.

Let’s transform the future of core banking together.